Monthly Market Outlook: Cattle Feeders Are Showing More Discipline

Cattle feeders are operating with new discipline in their purchases, largely dictated by shrinking access to capital and higher interest rates on the horizon

July 2, 2013

In his song “Summertime Blues,” country singer Alan Jackson croons: “Sometimes I wonder what I'm gonna do, ’cause there ain’t no cure for the summertime blues.” That seems appropriate with July upon us and impending challenges for the market.

As I mentioned last month, “the work that now lies ahead centers more on limiting downside risk vs. catching upside potential as we progress into summer.” This year’s seasonality is especially important given that it comes on the heels of a disappointing spring.

The market has seemingly been unable to break free from a persistent sideways-to-softer tone. With that in mind, market behavior over the next 6-8 weeks will provide important insight into some broader fundamentals underlying the market. The depth (or lack thereof) of this summer’s low could prove to be very telling about the state of the consumer and beef’s relative competitive position at both the restaurant and retail level.

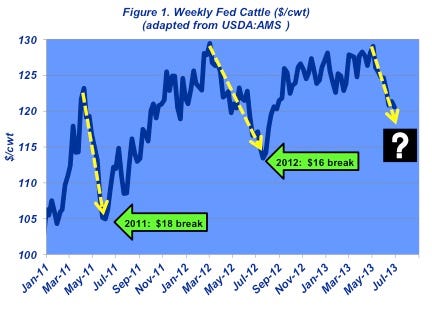

Figure 1 details weekly fed market trade, and highlights the relative price break from spring highs to summer lows during the past several years. As noted, the primary question going forward is how sharp that break might be in 2013. Much of that will be directly dependent upon wholesale prices. Correspondingly, Figure 2 illustrates similar aspects for the Choice cutout.

Based on performance of the past several years, the reasonable expectation would be a break of about $20/cwt. and $16-17/cwt., respectively, in the Choice cutout and fed market from their corresponding spring highs. That framework places the Choice cutout around $190 and the fed market at approximately $113 as low points for summer trade.

However, any concern around consumer perception of relatively high prices at the meat counter could prove to weigh heavily on movement during beef’s seasonally weak period. That would leave the market especially vulnerable to a deep trough as summer progresses. Conversely, if there proves to be some pent-up demand following this spring’s persistently gloomy weather, then consumers might afford the market some surprising resiliency.

Some leaning toward the latter follows reports of improved consumer confidence indicators during the month of June. Consumers are apparently feeling better about general economic conditions, which will perhaps translate into better-than-expected beef business through Labor Day. And as referenced last month, the beef complex needs to be encouraged by strengthening economic indicators on the consumer front, including better home prices. That ultimately translates into an enhanced perception of wealth (i.e., the “wealth effect’) and anticipation of more active spending.

To that point, the CME showed some formidable strength at the end of June. The August live cattle contract surged back to $122-123, firming from a double-bottom around $118. Assuming a $1-3 basis, that action places live cattle trade around $118-119 – far better than the $113 mentioned above. (That’s a long way from the $130 level traded around the first of the year, however.) Nonetheless, CME’s $118 for the August contract serves as a key level of support, and the market will need to be watched carefully.

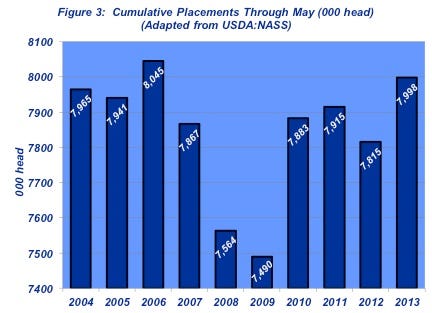

June’s Cattle on Feed report also provided some critical signals from a longer-run supply perspective. While the month-to-month aspects were fairly consistent with expectations, it’s important to note that total placements through May encroach 8-million head – the largest total in seven years, and 3% ahead of the five-year average (Figure 3). That number alone isn’t necessarily alarming, but it is significant given that it occurs against a smaller aggregate supply of feeder cattle.

Accordingly, active placements through the first half of the year only steepen the hill for sourcing feeder cattle toward the back half of the year. It also represents an ever-tightening deferred supply of fed cattle on the other side once those cattle move out of the pipeline. In the current supply environment, pulling cattle ahead creates an important challenge in terms of throughput continuity.

However, keep in mind that doesn’t automatically translate into a sellers’ market where buyers let down their guard. As noted last month, there’s been an important shift in price differences between fed and feeder cattle. That’s occurred because of the extended run of negative closeouts getting priced back upstream into the market.

Enjoy what you are reading? Subscribe to Cattle Market Weekly for the latest cattle price updates this fall!

The reality of those implications was underscored recently by a new Rabobank report entitled “North American Beef: The Liquidation Continues.” It states: “…before the U.S. cattle industry can begin to fully rebuild after several years of contraction, it is necessary for equity recovery to take place in the cattle feeding sector.” In other words, buying future replacements will have to be managed very carefully in an effort for feedyards to rebuild some equity. Cattle feeders are operating with new discipline in their purchases, largely dictated by shrinking access to capital and higher interest rates on the horizon.

That reality is critical to understanding weekly and monthly market influences. Meanwhile, the economy is seemingly in mid-cycle trying to find some direction while also navigating the twists and turns of future monetary policy. All of that highlights the amplified intricacies and complexities across the beef industry.

As always, it’s important to remind ourselves to remain fully informed and sustain objectivity around all aspects of the business.

You might also like:

Economists Say There's A Calf Price Rally Ahead

Picture Perfect Summer Grazing Scenes From Readers

Calf Marketing Tools Help Smooth Volatility

About the Author(s)

You May Also Like