Why has this year’s spring cattle market struggled to garner any of the optimism that was built into the futures market entering 2013?

June 5, 2013

Waiting and hoping. Those were the basic themes describing the cattle market at the beginning of May. That sentiment stemmed from disappointing spring action. My previous column also noted that the window of opportunity for seasonally better beef prices was rapidly closing. So, if better prices were going to get here, it all needed to happen soon.

The cattle market has proven to be relatively stubborn of late, refusing to offer any surprises to the upside (more on that later). Now we’re headed into the throes of summer, and the window for better prices has likely closed. The work that now lays ahead centers more on limiting downside risk vs. catching upside potential as we progress into summer.

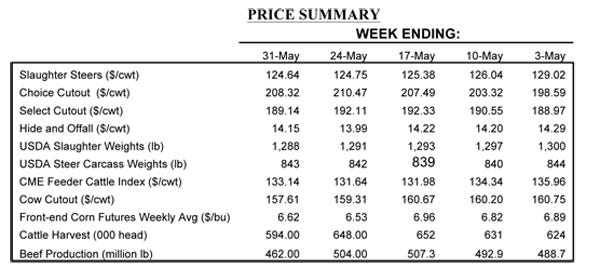

Nevertheless, wholesale beef prices finally made a move during May, with the Choice cutout surging to a new all-time record of $211+ just prior to Memorial Day. However, boxed-beef’s surge didn’t get translated into better cattle prices. Following the late-April/early-May mark of $129, weekly negotiations have been largely stagnant around $124-126 through the month.

Why has this year’s spring market struggled to garner any of the optimism that was built into the futures market entering 2013? There’s probably any number of explanations depending upon who you talk to. No doubt, gloomy weather has hindered outdoor grilling activity and opportunities to feature beef at the retail level. That weather also limits shopping and subsequent dining excursions.

Meanwhile, the ongoing pinch of increased payroll taxes, chronic unemployment and general economic uncertainty in the face of higher beef prices have also likely played a role. Lastly, the shuttering of the Cargill plant in Plainview, TX, has likely influenced negotiations, given the reduced number of slots to fill on a weekly basis.

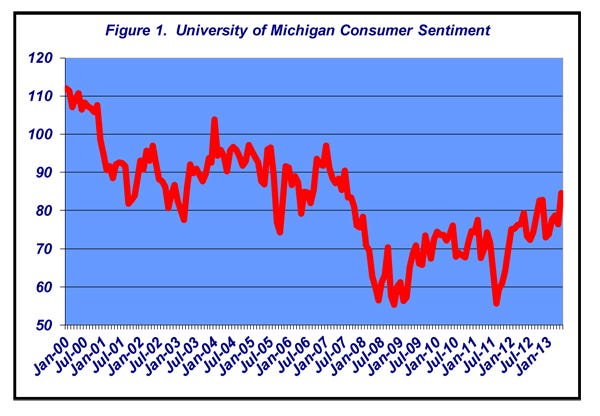

Even so, the beef complex needs to be encouraged by the cutout’s ability to push through the $200 resistance level and establish new highs. Moreover, there’s some indication the consumer might be waking up: University of Michigan’s Consumer Sentiment hit a six-year high in late May (Figure 1) on signs of improving home prices and stronger equity markets. With that, there’s still hope that consumers will make up for lost time and break out the grill with improving weather. If that’s the case, that should help underpin the market and limit downside potential as we progress through the summer.

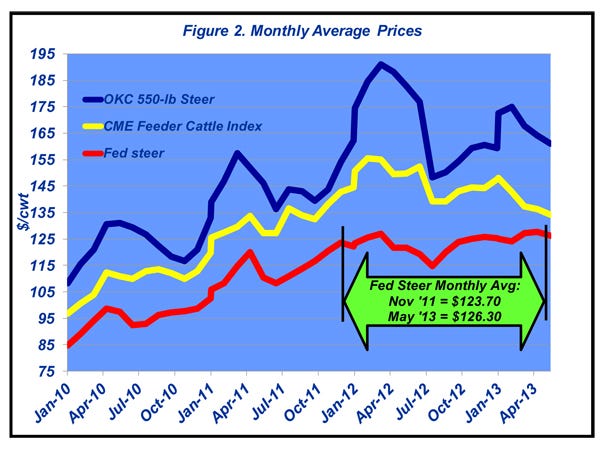

From a larger perspective, though, this spring’s market action sends some important signals relative to the beef business. Primarily, the fed market is seemingly caught in long-term consolidation. Fed cattle prices have been relatively flat during the past 18 months or so (Figure 2). Seemingly, there’ll need to be some major shift in fundamentals, from either the supply or demand side, to break into a new trading range.

During that time, though, calf and yearling prices have proven dynamic. The outcome being that price relationships have been, and still are, changing. At the front end of the fed market’s flat-line, cattle feeders had experienced a prolonged period of better prices. That’s because the favorable prospect at that time seemed to encourage buying feeder cattle and betting on the come of the fed market. Accordingly, prices got ratcheted ever higher.

In fact, those following that strategy and subsequently hedging that ownership when the futures market was peaking have been rewarded for their careful management. However, from strictly a cash-to-cash perspective with no hedging, that approach has proven to be regrettable, as closeouts have been horrific during much of that time.

What’s important here, though, are the changes in relative price differences. As mentioned last month, while feeder supplies are tight, cattle feed supplies are tighter yet. Feedyards have used that to their advantage. They’ve also worked hard to manage inventory and buy accordingly. And eventually, negative closeouts get priced back upstream into the market. The outcome being that leverage within the cattle complex is seemingly shifting – it’s no longer strictly a seller’s market. That reality is reflected by the narrowing margins over time (Figure 2): yearlings have retreated about $20/cwt., while calves have given up $30/cwt.

While some of that discussion was also included last month, it plays an especially important role in decision-making going forward for the cow-calf and/or stocker operator on several fronts.

First, we’re on the cusp of some important video sales over the course of the next 4-6 weeks. Results from those sales will be very telling about what price makers believe the market holds in store for the fall. Sellers will need to enter those sales aware that 2013 might prove somewhat different from the past several years; better year-over-year prices may not occur.

Second, given that fact, producers need to be increasingly cognizant of their cost structure in light of consolidating markets.

On that note, it’s important to reiterate an item mentioned last month: “…this year’s market underscores how challenging it is to navigate marketing decisions in the current business environment.” Cattle markets are never simple or easy – there’s always a lot of moving parts – nothing ever stays the same. With that said, be sure to remain informed and maintain objectivity around all aspects of the business.

You might also like:

60+ Stunning Photos That Showcase Ranch Work Ethics

Beef Producers Not So Optimistic In 2013

15 Best Photos Featuring Ranch Sweethearts

About the Author(s)

You May Also Like