Industry At A Glance: Change In Structure Of U.S. Beef Cow Operations

A 20-year decline in beef cow operations of 1-49 cows appears to have leveled off.

May 18, 2014

USDA’s 2012 Ag Census is now available and provides the industry some important perspective about the general structure and composition of production agriculture in the U.S.

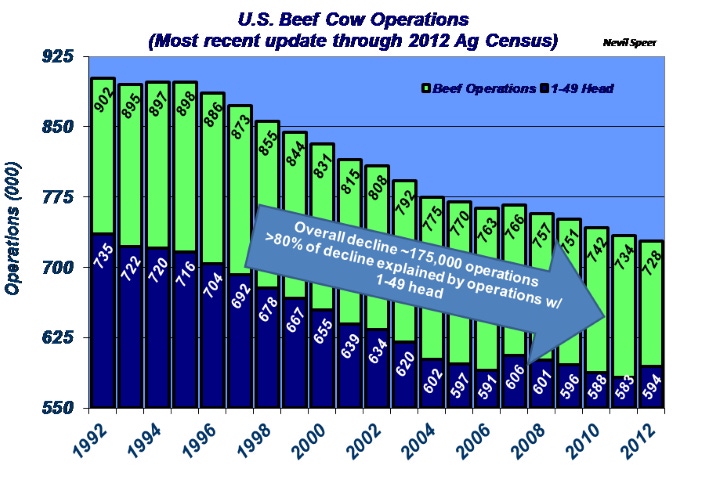

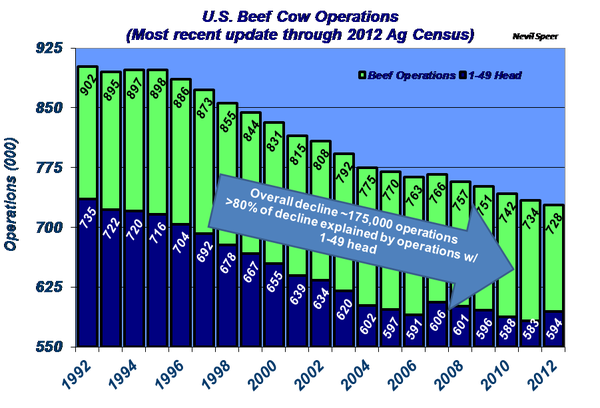

One of the most interesting aspects of the census comes from the overview of beef cow operations in the U.S. That’s especially true in light of the ongoing cowherd liquidation. The accompanying graph depicts the overall change in the producer segment over time.

During the past 20 years, the cow-calf sector has seen a decline of nearly 175,000 operations. The overwhelming majority of that decline (141,000 operations) has occurred within the category of operations maintaining 1-49 beef cows.

None of that is really surprising, as consolidation is an enduring theme across all of agriculture. That occurs because both sides of the profitability equation are squeezed with smaller operations. That is, fixed costs are inherently higher, as smaller operations have less ability to dilute them over a greater number of cows. In addition, marketing leverage for smaller operations is diminished in the marketplace due to inability to create full load lots, or even partial load lots.

As mentioned, the pattern has been an enduring one. However, the pace of reduction within the 1-49 segment has seemingly slowed and even leveled off during the past several years.

How do you see the structure of the cow-calf sector changing in the years to come? Will consolidation continue? Alternatively, has the segment seemingly reached some equilibrium? What are the implications to the industry going forward?

Leave your thoughts in the comments section below.

You Might Also Like:

2014 BEEF Stocker Award Nominations Are Open

Picture Perfect Summer Grazing Scenes From Readers

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)