U.S. Beef Herd Is Mostly Black But Changing Slightly

An exclusive BEEF survey indicates that while the trend for the cowherd to be straightbred and black continues, the genetic makeup of the nation’s cowherd is changing ever so slightly.

An exclusive BEEF survey bears out what anybody who has hung an eyeball on pastures and feedyard pens throughout cattle country has seen — the trend toward a cowherd that is straightbred and black is firmly in place.

However, there are indications that may change over time, as the genetic makeup of the bull battery is, if only slightly, beginning to change.

In an email survey in December 2013, cow-calf producers who read BEEF magazine shared their thoughts on what’s important to them when buying herd bulls. And while a black hide in and of itself doesn’t rank high compared with other traits, it doesn’t hurt, either.

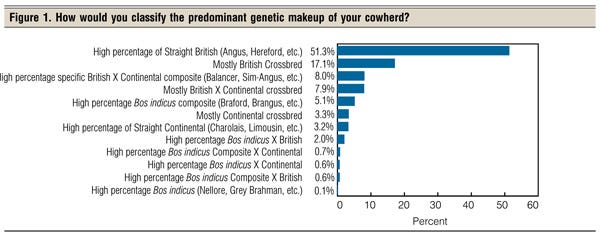

In fact, when asked to classify the predominant genetic makeup of their cowherd, 51.3% of survey respondents say it’s a high percentage of straight British, such as Angus or Hereford. Another 17.1% say mostly British crossbred. Eight percent say their cowherds were a cross of British breeds and Continental composites, such as Balancer or Sim-Angus; and 7.9% report a mostly British-Continental crossbred cowherd. Eared cattle, either straightbred or crossbred Bos indicus, combine to total 9.1%, and cowherds that are primarily Continental breeds came to 6.5% (Figure 1).

In spring 2010, BEEF conducted a similar survey of its readers. Four years ago, readers reported:

47.4% were a high percentage straightbred British (vs. 51.3% now)

20.5% mostly British crossbred (vs. 17.1% now)

11.7% mostly British-Continental crossbred (vs. 7.9% now)

6.6% mostly British-Composite cross (vs. 8% now)

6.3% Bos indicus or Bos indicus crosses (vs. 9.1% now)

6.9% Continental or Continental crosses (vs. 6.5% now)

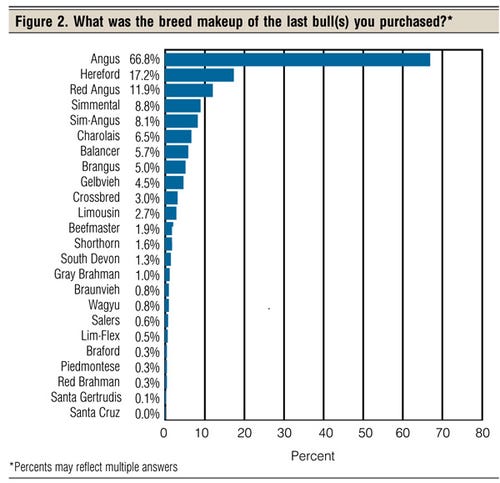

Looking at the top five responses in this year’s survey, 66.8% of all respondents say the last bulls they purchased were Angus. That’s steady with 2010, when 66% said they buy Angus bulls. However, Hereford, Red Angus, Simmental and Sim-Angus bulls all gained ground since 2010.

This year, 17.2% of readers added Hereford genetics to their cowherd, compared with 12.4% in 2010. Red Angus came in at 11.9%, compared with 8.8% in 2010, while Simmental ranked 8.8% and Sim-Angus came in at 8.1%. In 2010, those figures were 4.6% for Simmental and 5.5% for Sim-Angus (Figure 2).

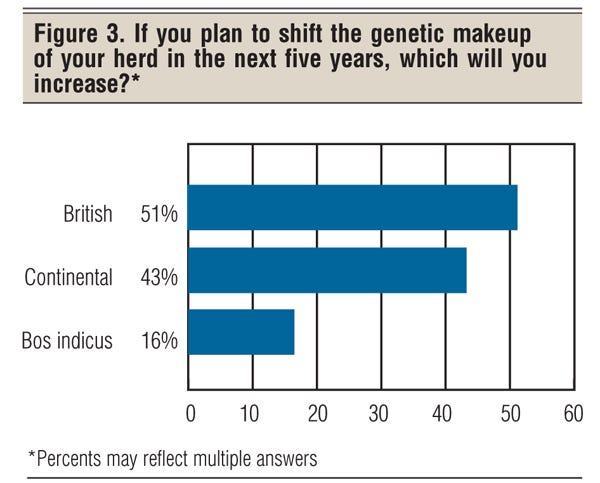

However, the majority of readers are happy with their genetics and breeding program. When asked if they plan to shift the genetic makeup of their cowherd in the next five years, 86.7% say no, while 13.3% say yes. Of those who do plan to change genetics, 51% say they plan to increase the percentage of British genetics; 43% say they will add more Continental genetics; and 16% plan to add some Bos indicus (Figure 3).

That’s a slight change from 2010, when 82.5% of respondents said they planned to stay the course with their genetics and 16.7% planned to change. However, of those who planned to change, the percentages shifted somewhat; four years ago, 60.4% said they would add more British genetics; 30.2% were looking at Continental genetics; and 7.5% wanted a little more ear in their cowherd.

Value-based marketing

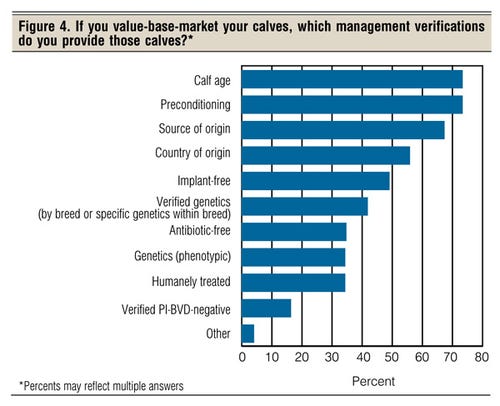

Some of the incentive to change cowherd genetics may come from the lure of various value-based marketing programs. In this year’s survey, 31.9% of respondents say they are involved in value-based marketing, while 68.1% are not. Regarding types of value-based programs, preconditioning, and source and age verification, are the most prevalent. In fact, in a dead heat for the top spot, 73.3% of respondents who participate in value-based marketing say they provide information on calf age, and the exact same number say they precondition their calves. Source of origin at 67.3% and country of origin at 55.8% were next, followed by implant-free at 49% (Figure 4).

Of those who do take part in a value-based marketing program, 17.7% say they’ve changed the breed of bull they purchased in the last five years, while 82.3% did not. What’s more, 13.4% say they changed seedstock suppliers in the past five years in order to participate in a specific value-added program. That’s up slightly from 2010, when 11.5% of respondents said they changed seedstock suppliers so they could participate in a specific value-added program.

And buying and owning the bull battery is still the most common way of acquiring bulls. Readers report that 79% of the bulls in the pasture are purchased and only 1.6% are leased. However, readers say 19.7% of the bulls are home-raised. Of the bulls that were purchased, 47% of readers say they bought from seedstock suppliers they’ve dealt with for more than five years. Meanwhile, 30.7% say they have dealt with their current seedstock supplier for 3-5 years, and 22.4% say they bought bulls from a seedstock breeder they dealt with for the first time. Just over half, at 50.8%, say they buy at private treaty, while 46.1% buy at live auction and 3.1% buy via video auctions.

Among commercial cow-calf operators responding to the survey, 45.2% use artificial insemination (AI). Of those using AI, 71% say they use the technology to breed both mature cows and heifers, while 24% use AI primarily on heifers, and 4.8% use it primarily on cows.

Among commercial cow-calf operators responding to the survey, 45.2% use artificial insemination (AI). Of those using AI, 71% say they use the technology to breed both mature cows and heifers, while 24% use AI primarily on heifers, and 4.8% use it primarily on cows.

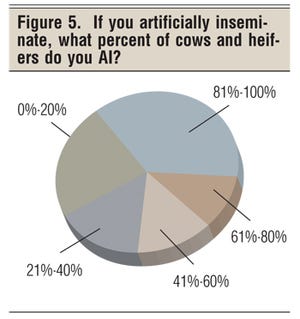

And those who use AI appear to rely on it heavily, with 37% reporting use of AI on 81%-100% of their cows and heifers. On the other end of the spectrum, 23% say they AI 0%-20% of their herd, followed by 16.1% who AI from 21%-40% of the herd (Figure 5).

Information is important

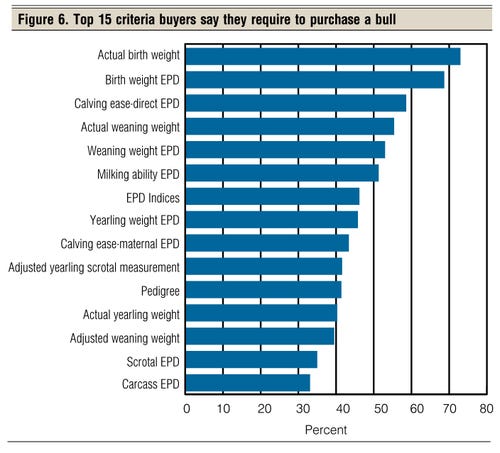

When asked to rank the information the respondents require when buying a bull, actual birth weight topped the list, with a 72.9% response. It was followed by birth weight EPD at 68.6%; Calving-Ease Direct EPD at 58.5%; actual weaning weight at 55.3%; and weaning weight EPD at 52.9%. Numbers total more than 100% due to multiple answers.

On the other end of the spectrum, performance traits in the feedyard and on the rail ranked lower overall. Carcass EPDs were identified as required information by 33% of readers; feed efficiency EPD by 28.3%; and feedlot performance EPDs by 17.9%. Only 11.5% of readers say they require genomic information (Figure 6).

However, 60% of respondents say they think they have a good understanding of the genomic information offered by seedstock suppliers. That’s up from 46.6% in 2010. Meanwhile, 38.9% of respondents in the latest survey say they use genomic data when making a bull-buying decision, compared to 30.2% in 2010.

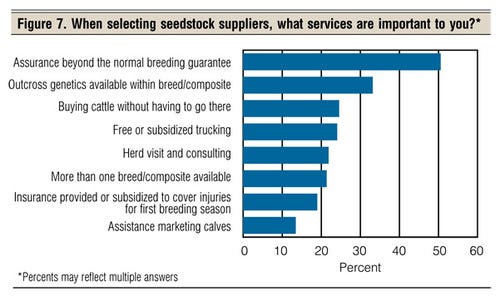

When asked what services offered by their seedstock supplier are important, assurances beyond the normal breeding guarantee topped the list, with a 50.5% response. Next, 33.1% of readers say outcross genetics available within a breed or composite are important. In a virtual tie, 24.5% say buying cattle remotely is important, followed by free or subsidized trucking at 24%; 21.8% say a herd visit or consulting is important; and 21.3% say they want more than one breed or composite available. Numbers equal more than 100% because of multiple answers (Figure 7).

In addition, 46.6% of respondents say a test for persistent infection with bovine viral diarrhea (BVD-PI) is important, and 40.6% say they want a breeding soundness exam (BSE) on the bulls they buy. However, 28.2% of respondents say “none” when asked which health-related tests are important to them. A Johne’s test was considered important by 26.2% of respondents, while a pulmonary arterial pressures (PAP) test was listed by 12.1%.

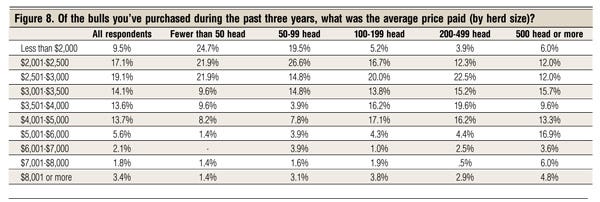

Another interesting result was the average expenditure on bulls (Figure 8). As the size of the operation increased (number of head), so did expenditures for bulls. The average price spent for bulls among respondents with fewer than 50 cows was $3,445/bull, while operators of more than 500 head spent an average of $4,130/bull.

Scott Grau, BEEF research manager, says the research results indicate that cow:bull ratios don’t differ by size of operation. “Thus, more than a factor than economy of scale, I think the higher expenditures on bulls by larger operations is due to a greater reliance than smaller operations on cattle for their livelihood. We see the same dynamic at play regarding participation in value-based marketing,” Grau says.

The bottom line to the overall results could be characterized as “the more things change, the more they stay the same.” However, while the BEEF survey indicates that the British breeds are firmly entrenched, there are indications that the makeup of the genetic base of the U.S. cowherd may be in the early stages of a change. Only time will tell.

You might also like:

Certified Angus Beef Has Raised The Quality Bar For U.S. Cattle

Despite All The New Selection Tools, Calf Birthweight Still Rules?

7 U.S. Ranching Operations Lauded For Top-Level Stewardship

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)