Industry At A Glance: Annual Boxed-Beef Sales By Category

Consumers are sending the message (via dollars) that they want to purchase beef that falls into the Prime, Choice and branded categories.

September 10, 2014

Several times in recent weeks, this Industry At A Glance column has featured some discussion around the influence of consumer spending from varying perspectives. These have included market share vs. pork and poultry; fed cattle prices; and the shifting category contribution within the boxed-beef market.

In aggregate, those illustrations depict a strengthening of consumer spending within the beef complex. Together, these have resulted in some key outcomes:

First, beef’s market share has stabilized; that’s especially important in the face of ever-higher retail prices and continued concerns about the strength of the consumer.

Second, it’s ultimately related to the amount of revenue coming into the industry and available to producers.

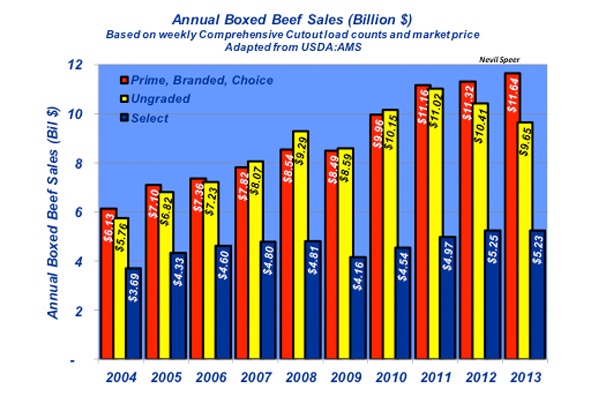

However, it’s important to understand the underlying cause. Last week’s Industry At A Glance chart provided some insight. However, the accompanying graph depicts changes over time in actual dollars. The category of Prime, Choice and branded is aggregated – those categories largely represent the decommodified, value-added portion of the market. The portion of Prime, Choice and branded sales now account for nearly 44% of total sales vs. just 38% in 2009 (amidst the peak of the financial crisis).

As alluded last week, the overwhelming cause of that shift has occurred because of changing sales volumes, not a shift in price differences across the category (though some of that is occurring at the very top end of the market). In other words, the increased revenue on the decommodified portion of the market is due to a greater portion of the boxed-beef load count headed in the direction of Prime, Choice and branded sales (vs. ungraded or Select).

That’s an important transition in the market. It’s clear that consumers are sending the message (via dollars) that they want to purchase beef that falls into the Prime, Choice and branded categories. Over time, there’s greater opportunity out there to market those types of products. Meanwhile, the production sector has responded favorably to that call – producers have clearly recognized the opportunity to garner extra revenue in meeting those specifications. That is, they’re producing cattle in greater numbers and producing more beef to meet that demand.

How do you foresee these market shifts being facilitated in the future? Will the beef complex continue to produce and market an even greater portion of Prime, Choice and branded products? Or will the marketplace stabilize at its current levels?

Leave your thoughts below.

Other stories you may enjoy:

Just When We Thought The Bubble Might Break, The Cattle Market Surprises Us

70+ Photos Honor The Hardworking Cowboys On The Ranch

Photo Tour: World's Largest Vertically Integrated Cattle Operation

Do You Want Progress Or Change In Cattle Breeding?

How To Prevent & Treat Pinkeye In Cattle

Two-Step Weaning System For Beef Calves

About the Author(s)

You May Also Like