BEEF Readers Say They’re Dedicated To Herd Expansion In 2014

An exclusive survey of BEEF readers indicates that herd liquidation is over and heifer retention is well underway.

All it took was a little rain and some green grass, and the appetite for heifer retention, long suppressed by withering drought, is growling again. According to a survey of BEEF readers, almost half of respondents say they are in full expansion mode.

When asked “What are your plans concerning your cowherd size in 2013-2014?” 33.5% of respondents indicate they plan to expand by 1%-10%. Another 13.4% say they plan to expand by 11% or more. However, 38% say they’ll stay with about the same number of cows they’ve carried the past year, while another 4.7% say they will stay with the same number of cows but add other enterprises to the operation, such as stockers or a commercial heifer development program.

Very few respondents indicate they plan to cut herd size in the coming year. Only 4.8% indicate they will get smaller by 1%-10%, and another 2.5% plan to cut back 11% or more. Of those who plan to cut back, age and drought are the primary reasons for cutting back; 35.7% said they’re getting older and want to cut back, and a similar percentage say drought is still a concern. In addition, 16.7% say feed costs are still too high and 14.3% say land is too expensive.

Of course, weather and other factors can quickly change the best of intentions. In fact, in 2011, 33.7% of cow-calf producers responding to a January BEEF survey reported their intention to expand their cowherd size by 1%-10% that year, while 19.1% planned to expand by 11% or more. A combination of continued drought in major parts of cattle country, high inputs and a shaky economy altered many of those intentions.

Producers optimistic in long term

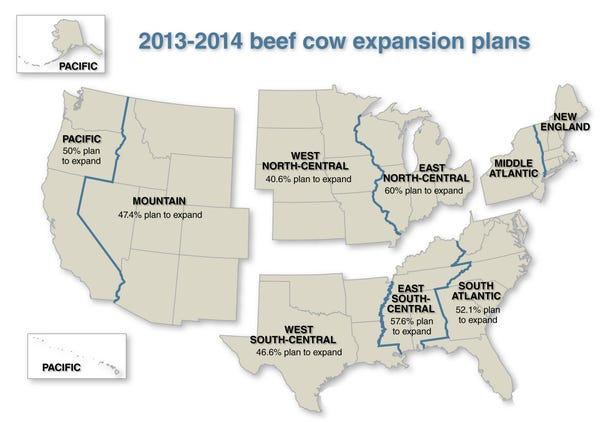

Folks in agriculture are die-hard optimists, and respondents to the latest survey feel good about the future. When asked their plans regarding cowherd size for the next 3-5 years (2014-2019), 31.5% of respondents say they plan to expand 1%-10%, while another 24.2% say they plan to expand by 11% or more. Combined, more than half of the respondents (55.7%) indicate they will continue growing their cowherd for the next few years.

Another 29% plan to stay with the same number of cows they have now, and 6.2% plan to add other enterprises to the mix. Only 3% say they plan to cut back by 1%-10% in the next 3-5 years, while 1.9% will pare down by 11% or more. Another 1.6% plan to get out of beef production but not retire, and 2.7% plan to retire in the next 3-5 years (see Figure 1).

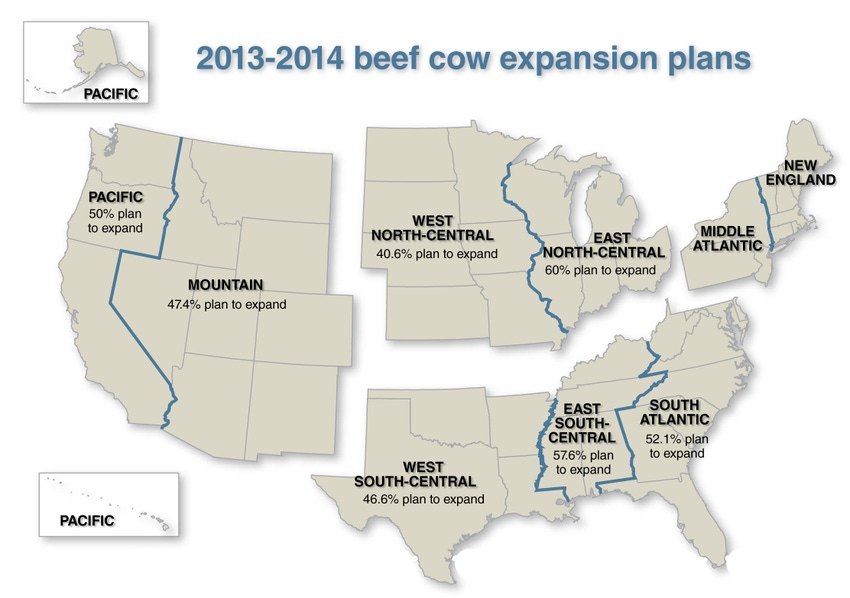

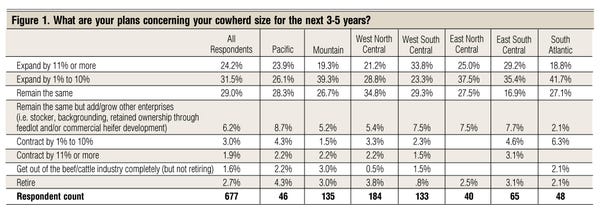

The picture becomes even more interesting when looking at the geographical breakdown of respondents. While producers in all regions indicate plans to expand, the largest percentages aren’t in the Great Plains.

Switching to a shorter-term outlook, the region with the highest percentage of those who plan to increase their cowherd size in 2013-2014 is the East North-Central (WI, IL, IN, MI and OH). In total, 60% of respondents from those states indicate they’ll expand either from 1%-10%, or 11% or more. Close behind is the East South-Central region (KY, TN, MS and AL) at 57.6%, followed by the South Atlantic (MD, DE, WV, VA, NC, SC, GA and FL) at a combined 52.1%.

Subscribe now to Cow-Calf Weekly to get the latest industry research and information in your inbox every Friday!

Next in line are producers in the West. The Pacific region (CA, OR and WA) showed that 50% of respondents from that area plan to expand, while 47.4% of producers in the Mountain states (MT, ID, WY, CO, UT, NV, AZ and NM) said they plan to grow their herds in the coming year.

Riding drag are producers in the Plains states. Of the respondents in the West South-Central states (TX, OK, AR and LA), 46.6% indicated they’ll add to their cowherds, while 40.6% of producers in the West North-Central region (ND, SD, MN, IA, NE, KS and MO) said they plan to add more females to the herd (see map above).

How they're expanding

Heifer retention is far and away the chosen method of growing the cowherd by BEEF survey respondents, with an 80.8% tally mark. Another 40.9% say they will buy replacement heifers (totals add up to more than 100% because some respondents will both keep heifers and buy replacements). Another 12.3% will cull fewer cows, and 2.8% plan to lease cattle or run them on shares.

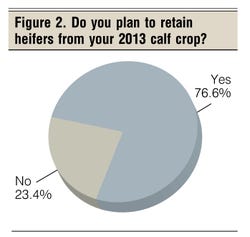

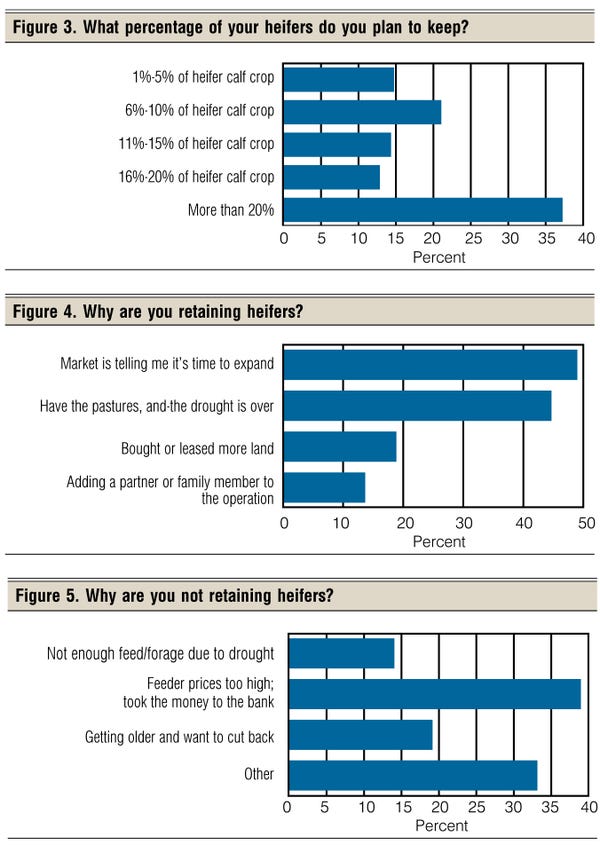

In fact, when considering their 2013 calf crop, 76.6% of respondents plan to keep females back for breeding (see Figure 2). Of those, 37.2% say they’ll keep 20% or more of their 2013 heifers to develop and evaluate as brood cows. Another 21% plan to keep 6%-10% of their heifer crop; 14.7% plan to retain 1%-5% of their heifers; 14.3% plan to hold onto 11%-15%; and 12.8% say they’ll keep back 16%-20% (see Figure 3).

In fact, when considering their 2013 calf crop, 76.6% of respondents plan to keep females back for breeding (see Figure 2). Of those, 37.2% say they’ll keep 20% or more of their 2013 heifers to develop and evaluate as brood cows. Another 21% plan to keep 6%-10% of their heifer crop; 14.7% plan to retain 1%-5% of their heifers; 14.3% plan to hold onto 11%-15%; and 12.8% say they’ll keep back 16%-20% (see Figure 3).

The incentive for heifer retention comes from a combination of Mother Nature and market signals. When asked “Why are you retaining heifers?” 48.9% said, “The market is telling me it’s time to expand,” while 44.6% say, “Have the pastures, and the drought is over.” In addition, 18.8% of respondents bought or leased more land, and 13.6% are adding a partner or family member to the operation. Figures add up to more than 100% because of multiple answers (see Figure 4).

Some respondents, however, don’t plan to keep their heifers. The market is also the primary factor in the decision by readers not to retain heifers. Of those respondents, 38.9% said they took the girls to town because feeder prices were so high. Another 19.1% said they’re getting older and want to cut back, while 14% are still dealing with drought and say they don’t have the feed or forage to justify expansion (see Figure 5).

However, 33.1% of respondents had other reasons for not keeping heifers back for breeding. “There’s as good of quality out there for sale, and I get a calf sooner,” one reader remarked.

Earnest about holding heifers

Earlier in 2013, industry analysts speculated that cattle producers attempted to begin herd expansion in 2012, but drought and high prices drove many of those heifers to town. BEEF readers indicated they kept heifers in 2012, but seemed to buck the trend of letting them go early.

Almost 71% of respondents say they kept heifers in 2012 for breeding purposes, with 28.6% keeping more than 20% of their 2012 heifer crop, and 23.6% keeping 6%-10%. An almost equal number split the difference — 14.5% of respondents kept 16%-20% of their heifers, and 14.7% kept 11%-15% of their 20912 heifer crop. Another 18.6% kept 1%-5% back.

However, 62% said “no” when asked if they sold some or all of their 2012 retained heifers as feeder cattle. Of those who did sell, the majority (57.9%) sold less than 25% of the heifers they kept back to develop into breeding stock. A little over 19% sold 26%-50% of their retained heifers; 14.2% sold 51%-75%, and only 8.7% sold 76%-100%.

Analysts have also speculated that, because of drought and the culling that ensued, the cowherd is younger than in years past. BEEF readers, reporting on their cowherds, seem to bear this out.

On average, survey respondents run around 300 cows. Respondents report that 42.6% of those cows are from 2-5 years old, and 42.5% are 6-8 years old. Only 14.9% of the cows are 9 years or older.

Bull prices continue to climb

BEEF also asked readers about bull-buying trends in 2013. Just over half the respondents, 54.5%, bought bulls in 2013 and 65.1% said they paid more in 2013 for bulls than they paid in 2012.

On average, respondents paid around $3,500 /bull in 2013. Of those who bought bulls, 36.6% paid between $2,500 and $3,499/head for their bull power, and 23.5% paid from $3,500 to $4,499/head. Another 18% paid less than $2,500 for their bulls, while 14.4% paid from $4,500 to $5,499/head. The remaining few respondents (7.5%) paid $5,500 or more for their bulls.

Marketplace indicators show herd expansion is underway, and BEEF readers are apparently aggressively acting on signals by holding heifers.

You might also like:

Photo Gallery: Santa's Little Ranch Helpers

2014 Will Be A Record Year For Calf Prices And Risk

3 Lessons From A Greenpeace Dropout

More Consumers Are Realizing The Dishonesty Of The Animal Rights Industry

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)