Average Value Of U.S. Pastureland Is $1,200 Per Acre

Pasture prices continue to climb – despite the ongoing decline in the country’s cattle herd.

October 25, 2013

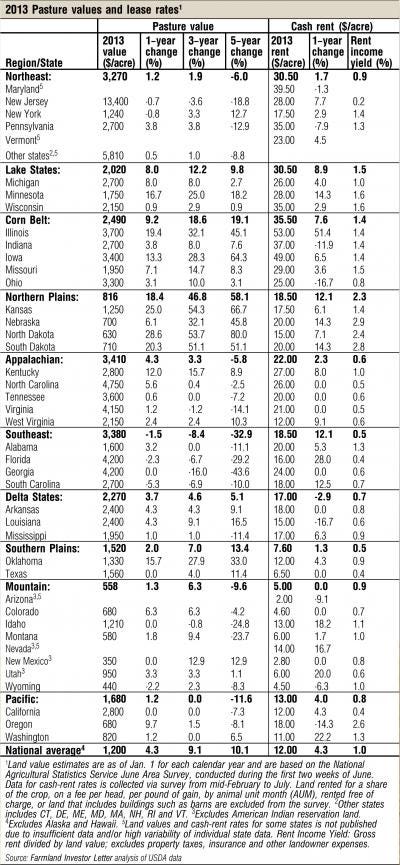

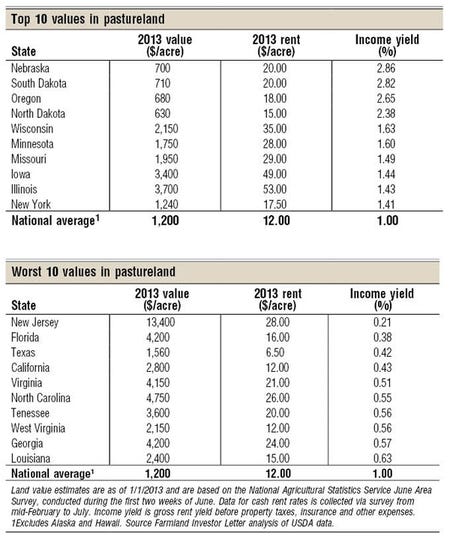

The average value of U.S. pastureland rose 4.3% through the start of this year to $1,200/acre, according to USDA. That’s another new nominal high, but one-third the pace of the booming cropland market, where values inflated another 13% to an average of $4,000/acre.

Low interest rates, low returns from other types of investments and high livestock prices continue to support pasture values. Pasture prices continue to climb — despite the ongoing decline in the country’s cattle herd — as producers scramble for grazing land as a less costly alternative to grain-based rations.

Kansas feedlots are paying an estimated $1.19/lb. to finish steers, and losing $112/head, according to August projections by Kansas State University. That’s more than double the 42¢/lb. of gain that Flint Hills pasture owners charged for summer leases based on weight gain. Little wonder that 97% of available Flint Hills pasture was contracted by mid-April.

Northern Plains spike

Regionally, pasture-value changes continue to vary widely. Price inflation remains steepest in the Northern Plains, where values jumped 18%. That’s down from last year’s 22% spike, but more than four times the national average. Elsewhere, prices rose in the single digits, from 8% to 9% across the Lake States and Corn Belt, to 4% in the Delta and Appalachian states and 1% to 2% across the Pacific, Mountain and Southern Plains regions.

2013 Pasture values and lease rates (click to expand)

Pasture prices in the Southeast finally appear to be stabilizing, slipping just 1.5%, for the 12 months through Jan. 1, vs. last year’s 7% drop. For the 12 months through this year’s second quarter, pasture prices in Alabama, Florida and Georgia are up an average of 1.7%, according to Mid-South/Southeast Farmland Market Trends, a quarterly survey.

Pasture-price increases are strongest in the western Corn Belt, where last year’s high grain prices and lease, and royalty profits from shale oil and gas development continue to propel the value of all tillable land. In North Dakota, epicenter of the Bakken shale oil fracking frenzy, pasture values spiked nearly 29% to an average of $630/acre. This leap still trails the 41% rise in North Dakota cropland values, and suggests buyers may be bidding up pasture tracts that have the potential to be converted to row-crop production.

In South Dakota, native rangeland values inflated 23% to $909/acre for the year through Feb. 1 period, according to South Dakota State University (SDSU). Tame pasture values climbed 27% to $1,542/acre.

A new study published in March by SDSU estimates that 1.3 million acres of grassland were converted to crops in the Dakotas, Minnesota and Nebraska between 2006 and 2011. Such sod-busting for corn and soybean cropping has been concentrated in the Dakotas, east of the Missouri River. The magnitude of this conversion is similar to the peak rates documented during the 1920s and ’30s, when tractors and other mechanized equipment came into widespread use, say study authors Christopher Wright and Michael Wimberly.

Surveys of market conditions through this year’s first half indicate that pasture values continue to inflate at a double-digit pace across the West Central Plains (Kansas, western Missouri and Nebraska), and by single digits elsewhere, according to the Federal Reserve. Pasture values are up an average of 15.7% through June compared to a year ago across those states.

Nebraska demand remains hot

Buyer demand appears strongest in Nebraska, where pasture tracts are trading at an estimated $1,388/acre, or 18% above midyear 2012 levels.

In neighboring Kansas, quality bluestem pasture is fetching $1,500-$2,000/acre — unchanged from a year ago, says Richard Griffin, with Griffin Real Estate and Auction Service in Cottonwood Falls.

“Everyday ranchers who make their living running several hundred head of cattle are sitting back and waiting until we have an adjustment down,” Griffin says. “If CD rates start paying 3% to 4%, I don’t think people will invest in land; they will leave their money in cash.”

In the southern Midwest and northern Mid-South, pasture values are 1% above a year ago, and range from $1,757/acre in the Memphis region to $2,913/acre in the St. Louis region, according to the Federal Reserve.

In the North Central region, pasture values were up 9% for the 12 months through June. Prices range from an estimated $488/acre in Montana to $544 in North Dakota, $1,783 in South Dakota, $2,250 in Minnesota and $2,275 in Wisconsin, reports the Fed.

In Texas, ranchland values were trading mostly even for the 12 months through June. The Northern High Plains remains a hotbed of activity, driven by interest in grassland that can be developed into irrigated cropland. Here, ranchland values have risen 14% to an estimated $527/acre, the Fed says.

Cropland expansion pushes pasture rents

Pasture rents continue to be pressured higher by demand for row-crop land expansion and the higher profits derived from crop production.

In Kansas’ 14-county Flint Hills region, which often serves as a benchmark for pasture rates across the Plains, full-season summer contracts (with and without caretaking) averaged $21.10/acre this year, according to the Bluestem Pasture Release, published by the Kansas Department of Agriculture and the National Agricultural Statistics Service. Lease rates ranged from $20.40/acre in the southern zone to $21.80/acre in the central zone. Full summer-season contracts typically commence around April 24 and end Oct. 17.

Partial-summer season contracts, which can include both early intensive grazing and three-quarter-length season reports, averaged $23.70/acre, and ranged from $22.10/acre in the southern zone to $25.90/acre in the central zone.

Landowner caretaking services usually include burning and fence maintenance, and can include a guaranteed head count, salt and minerals, and weed control.

Surveys of market conditions through this year’s first half indicate pasture rents are up an average of 4% from a year ago across Kansas, Iowa, Missouri and Nebraska. Meanwhile, rates have climbed nearly 16% in the Mountain States of Colorado, New Mexico and Wyoming.

Ranchland lease rates range from $65/acre in Nebraska to $55/acre in western Missouri, $24/acre in Kansas, and $18/acre in Oklahoma. They average $16/acre across Colorado, northern New Mexico and Wyoming, according to bankers surveyed by the Federal Reserve in June.

At midyear, bankers say pasture lease rates this year vs. a year ago in the North Central U.S. ranged from up 27% in Minnesota to up 6% in South Dakota. Rents averaged $96/acre in Minnesota, $53/acre in South Dakota and $24/acre in North Dakota.

Across the southern Midwest and northern Mid-South, pasture rents range from $88/acre in the Louisville region to $52/acre in the Memphis region, says the June Fed survey. A midyear survey by the Illinois Society of Professional Farm Managers and the University of Illinois estimated that the average statewide charge for pasture rents is $40/acre. That’s slightly under USDA’s 2013 rent survey, which pegged state-level pasture rents steepest in Illinois, at an average $53/acre.

At the county level, the five highest average pasture lease rates are $77.50/acre in Iowa’s Harrison and Pottawattamie counties; $76/acre in Fulton County, IN, and Lebanon County, PA; $70.50/acre in Cuming County, NE, and Washington’s King and Whatcom counties; $70/acre in Iowa’s Crawford and Shelby counties; and $69.50/acre in northeast Nebraska’s Pierce County.

In Indiana, pasture lease rates average $94/acre statewide, ranging from $65/acre in the southeast to $135/acre in the west-central region, according to a June survey by Purdue University. Lease rates for established alfalfa/alfalfa-grass hay ground average $175/acre, and range from $121/acre in the southeast to $208/acre in west-central Indiana. Grass hay rents average $136/acre (range: $72-$173).

Michael Fritz is editor and publisher of Farmland Investor Letter. Reach him at [email protected] or visit farmlandinvestorcenter.com.

You might also like:

15 Questions To Consider Before Buying Farmland

Are We Headed For A Farmland Crash?

Photo Gallery Highlights Generations On The Ranch

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)