Cattle feedlots decline in USDA Census

Results reveal fewer smaller feedlots marketing fewer cattle.

March 14, 2024

By Matthew Diersen, South Dakota State University

In mid-February, the USDA National Agricultural Statistics Service (NASS) released the 2022 Census of Agriculture. The Census provides a comprehensive look at the structure of agricultural that complements the regular survey work on NASS, such as “Cattle on Feed” reports. For perspective, in 2022 there were 732,123 farms across the U.S. with a total inventory of 87,954,742 head of cattle. Both the number of farms with cattle and the total inventory of cattle are down or lower than when last measured this way in 2017. The Census provides different breakdowns of cattle on feed that give insights into feedlots and related trends.

Having cattle on feed is a specialized enterprise. Only 22,613 farms had cattle on feed in inventory at the start of 2022, down from 25,776 farms in 2017. Farms with 1-19 head on feed stayed constant in number, likely retained ownership for local consumption instead of a budding enterprise. The number of farms in the other small inventory levels, 20 to 999 head, all had significant declines, similar to or driving the overall decline in farms with cattle on feed. The largest inventory levels, 1,000 to 2,499 and 2,500 or more head, were relatively constant. Those largest categories also had increases in the number of cattle on feed compared to 2017. Thus, farms with small feedlots have become less common (either temporarily or permanently) while the largest feedlots have become larger.

The Census breakdown by cattle on feed sold reflects a similar contraction by farms with smaller feedlots. A total of 25,783 farms sold cattle on feed in 2022, down from 30,273 farms in 2017. All of the categories with 1 to 999 head had fewer farms represented with fewer aggregate head sold also. There were more farms with 1,000 to 2,499 head sold in 2022 than in 2017 and with a greater aggregate number sold. Farms with the largest sales levels had mixed results that did not change as much as among the other farms. Consistent with the inventory levels, there were fewer smaller feedlots marketing fewer cattle.

Spatially, the largest feedlots dominate inventory levels and changes in Texas, Nebraska, and Kansas. The Census gives a breakdown of custom fed cattle by state. While the U.S. saw fewer feedlots with custom feeding, 853 in 2022 versus 1,070 in 2017, the aggregate number sold was higher at 10.1 million head in 2022. Kansas feedlots had the most head custom fed, followed by Nebraska, then Texas. Iowa led states with 155 farms with custom feeding. In terms of changes in farms with feedlots, there were relatively more feedlots with more inventory in Washington, Oregon, and Idaho compared to 2017. There were relatively fewer feedlots with less inventory in Iowa and Minnesota, and to a lesser extent the neighboring states of Illinois and South Dakota.

The markets

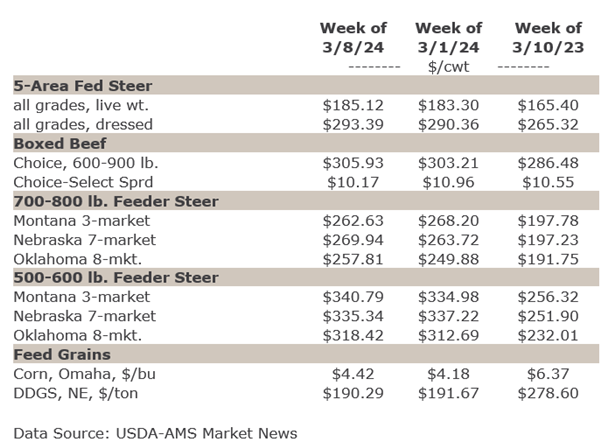

The cash market was higher for fed cattle and boxed beef last week. The futures for live cattle were steady for the nearby and higher for the deferred contract months. Cash prices for feeders were mixed. The feeder futures prices were also steady for the nearby and higher for the deferred contract months. Cash corn and nearby corn futures prices were sharply higher for the week.

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)