While news about China is exciting, impact on U.S. beef exports still unknown

The U.S. and China must first undergo detailed negotiations before any beef shipments can occur.

October 11, 2016

It was hard not to be excited when China’s regulatory agencies announced they had lifted their 13-year-long ban on imports of U.S. beef. China is, after all, the fastest-growing beef import market in the world and the only major destination that never reopened to U.S. beef following the December 2003 BSE case.

But while lifting the import ban is a critical first step toward the resuming U.S. beef exports to China, no product can be shipped until the two countries reach agreement on specific export requirements. It’s not possible to say how long this process will take, or what the final terms will be.

In its statement announcing the lifting of the ban, China’s Ministry of Agriculture (MOA) provided only a few basic details. MOA makes reference to a 30-month cattle age limit and mentions boneless and bone-in beef. If a 30-month age limit is imposed, it will exclude only a small percentage the U.S. fed cattle slaughter.

Including both bone-in and boneless cuts is important, however, because some of the more popular items in China – as in other Asian markets – are bone-in. But it is important to keep in mind that when the final import protocol is published, the details could go well beyond these basic parameters, especially with regard to cattle eligibility. Further work is needed before we know these details, which will ultimately determine the volume of U.S. beef that is eligible for export to China.

Traceability is certainly a key component, and producers are understandably anxious to know what they need to do in order to ensure that beef from their cattle will be China-eligible. Unfortunately, however, it is too soon to issue any specific guidance on this topic. Producers who have used source and age verification services to capitalize on opportunities in markets such as Japan, or to participate in the non-hormone treated cattle (NHTC) program for the European Union, know that successfully utilizing these programs requires careful planning, execution and record-keeping. That is why it is important to focus on known facts and to refrain from speculating on China’s requirements.

90 stunning fall photos from the ranch

Autumn is here, and ranchers are busy silage cutting, weaning, working calves, preg-checking, and getting ready for winter. See photos here.

The one area we can discuss with some degree of certainty is the growing demand for beef in China. In the pre-BSE era, China was not an extremely large destination for U.S. beef, or for beef from any of the world’s major suppliers. China’s total beef and beef variety meat imports in 2003 were 57,199 metric tons (mt) valued at $64.4 million.

With U.S. beef gone from the market, China’s imports slumped until 2010, when they rebounded to about 33,000 mt valued at $103.8 million. Over the next five years, import growth accelerated dramatically. In 2015, China’s imports reached almost 500,000 mt valued at just under $2.4 billion.

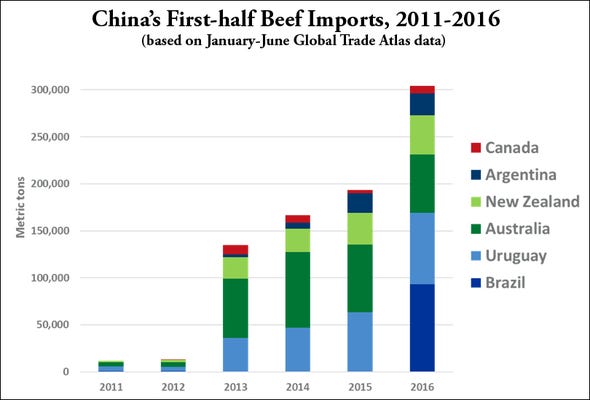

This year, through August, imports are well ahead of their 2015 pace – up 45% in volume (415,000 mt) and 33% in value ($1.8 billion). After regaining access to China in mid-2015, Brazil quickly emerged as its largest supplier, followed by Uruguay, Australia, New Zealand, Argentina and Canada (Figure 1).

“China’s beef import growth has been remarkable, and buyers consistently express a very high level of interest in high-quality, grain-fed U.S. beef – the type of product that can be difficult for them to obtain from other suppliers,” said Joel Haggard, U.S. Meat Export Federation (USMEF) senior vice president for the Asia Pacific. “But demand is only part of the equation, and it is important that we know the product eligibility requirements and other details before we attempt to project how much new business this market could generate.”

Figure 1: Chinese beef imports grow over time

China’s tariffs on imported beef are significant, but not prohibitive. Frozen and chilled beef from most foreign suppliers is subject to a 12% tariff. New Zealand was the first beef supplier to reach a free trade agreement with China (in 2008), and under this FTA tariffs on New Zealand beef were gradually eliminated by 2016. Australia signed an FTA with China last year, so tariffs on Australian beef will be phased out over the next nine years. China also has an FTA in place with Chile, but China imports only a very small volume of Chilean beef.

Joe Schuele is vice president, communications, with the U.S. Meat Export Federation in Denver, Colo.

You might also like:

15 favorites from fall photos on the ranch

4 questions to ask before marketing 2016 calves

9 new pickups for the ranch in 2016

Seven keys to ranch profitability

How to cull the right cow without keeping records

Burke Teichert's top 5 tips on bull selection

Young ranchers, listen up: 8 tips from an old-timer on how to succeed in ranching

You May Also Like