Packer Margins Continue To Languish

It’s likely that another beef slaughter plant could close before cattle numbers possibly increase in late 2014 or 2015. That’s assuming a return to normal rainfall in major grazing areas this year.

February 26, 2013

A critical leverage point in livestock and meat markets is packer margin. While producers determine long-run product supplies and the timing of those supplies with their decisions to breed animals and, in the case of cattle, place them on feed, packers make critical short-run decisions on how many animals to harvest and, consequently, how much product to put on the market given current demand and pipeline stocks. Packer margins have longer-term impact on the performance of packing companies and balancing capacity with animal numbers. And the picture for packer margins hasn’t been good of late.

First, a word about the calculated margins shown in the accompanying charts. These are gross margins that represent the difference between the value of the wholesale meat products and by-products sold by packers less the cost of the animals. They represent steers/heifers and barrows/gilts only as those are the primary product supply chains. That is not meant to diminish the importance of cull cow/bull and sow/boar markets. It’s just an acknowledgement that the young, top animals represent the vast majority of the volume and the value in both species.

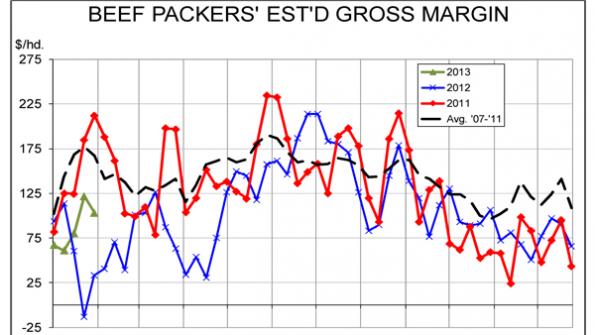

Our beef calculations use an average cutout value that includes both the Choice and Select cutouts weighted by the each grade’s share of a given week. The beef by-product value comes directly from USDA’s by-products report. Cattle costs are the weighted average total cost as reported by USDA for live and dressed steers and heifers.

For the hog margins, we use USDA’s estimated 51-52% lean cutout value and the average carcass weight for all barrows and gilts to estimate revenues. The national weighted average net price of all purchased barrows and gilts (which included some pigs that are sold by packers to other packers) and carcass weight from USDA. By-product values are based on calculated per-head values from the Livestock Marketing Information Center.

We stop at a gross margin level of detail for two primary reasons:

First, we don’t have operating-cost data for packing plants – or at least enough plants to determine an average slaughter/processing cost for either of the two species sectors. Combine that with the fact that costs are likely quite different across plants, and we just have little confidence that any one number represents operating costs very well.

Second, we believe that operating costs are pretty stable in any given plant, meaning that the variation in gross margins is very close to the variation in net margins and thus equally indicative of packers’ desires and motivations to alter prices paid and/or operating rates. The one weak point in that argument is the impact of capacity utilization on average operating costs, and thus net margins.

Packers can live with slightly tighter margins when slaughter totals are large but need higher margins when numbers are tight. Of course, the supply situation for animals pushes margins in just the opposite direction – tighter when numbers are low and wider when numbers are high.

All of this is a prelude to point out that packer margins have not been good at all. Beef packer margins were below the 2007-11 average for virtually all of 2012 and were FAR below those historical levels in Q1-2012. From August onward, gross beef margins were lower than the five-year average every week except three, and have been lower than that average every week so far in 2013.

Further, the net margins since August have been, by all reports, deep in the red – a factor which, along with prospects of lower cattle numbers in coming months, contributed to Cargill’s decision to close its Plainview, TX, plant. It’s likely, in our opinion, that another beef slaughter plant could close before cattle numbers possibly increase in late 2014 or 2015, assuming a return to normal rainfall in major grazing areas this year.

On the hog side, that sharp decline in margins the past two weeks were apparently the final straw, as packers took slaughter down nearly 4% from week-earlier levels last week. Weather was a contributor to that decline but trade reports indicate that product has just not been moving at a rate to justify continued runs of 2.1 million and more. The slowdown pushed cash hogs below $80.

You May Also Like