The strength of any company or industry is ultimately based on its ability to generate revenue.

June 10, 2014

My April 30 Industry-At-A-Glance chart featured the comparative meat expenditures of beef, pork and poultry, and beef’s relative market share. As noted in the discussion, the strength of any company or industry is ultimately based on its ability to generate revenue. All money coming into the industry is sourced from sales, and opportunities for future growth are contingent on the ability to ramp up revenue. And those sales dollars ultimately get passed back through the supply chain.

Subscribe now to Cow-Calf Weekly to get the latest industry research and information in your inbox every Friday!

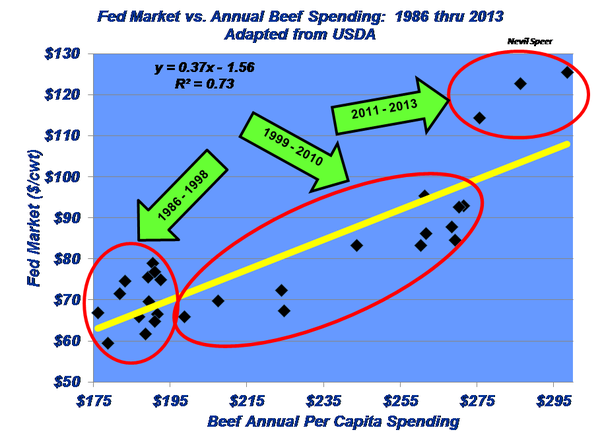

With all that said, what’s presented in the accompanying chart outlines the relationship between per-capita spending and fed cattle price. It’s important to note at the outset that the graph is not, nor is the intent to be, a direct reflection of beef demand. Rather, it simply speaks to the importance of the relationship between total dollars being spent by consumers and that influence on fed price (and thus total dollars coming back into the production sector).

No doubt, at this point, there’ll be some consternation because this doesn’t account for tight supply, which helps fuel fed cattle prices. That’s certainly an accurate observation. Declining cattle numbers mean diminished supply and have supported prices due to general over-capacity within the processing sector: more slots chasing fewer cattle.

Simultaneously, fewer cattle also mean declining production – that inherently spells less total product for consumers to buy and drives retail prices higher. However, if the product is not favored, or is competitively weak in the marketplace, the industry possesses little pricing power.

It’s clear that beef has been able to push higher prices onto consumers during the last several years. Supply issues aside, had that not been possible, cutout values would have ultimately suffered and translated into weaker fed cattle prices (at least being softer than what they have been). That’s a very different scenario vs. the 1990s when beef had little pricing power and was losing market share to pork and poultry.

Looking into the future, how do you perceive the beef industry’s ability to continue to grow total spending by consumers? Will that be on a volume basis, a price basis, or both? What opportunities are available out in the marketplace for beef to expand and generate revenue growth (and drive fed prices even higher)?

Leave your thoughts below.

You Might Also Like:

10 Resources To Ensure You Get More Cows Bred

About the Author(s)

You May Also Like