Challenges persist in Japan’s beef market, but positive signs emerging

With U.S. beef supplies tightening and prices for short plate increasing sharply, alternative cuts are attracting increased interest from Japanese buyers.

Having just returned from my first 2024 visit to Japan, I saw firsthand the headwinds weighing on Japan’s economy but still came away encouraged about the long-term prospects for U.S. beef in this critical market. On one hand, the business climate in Japan is dynamic, with exporting companies benefiting from the weak yen, and the stock market – while down from its March highs – has benefited from investors seeking value. But conversely, businesses and consumers reliant on imports are dogged by a persistently weak yen.

After devaluing by a further 10% since the first of the year and reaching the lowest level versus the U.S. dollar since 1990, the Bank of Japan stepped in to slow the decline by buying yen on April 29. The plunging yen places intense pressure on consumers, who face higher prices for a wide range of imported products. The combination of inflation and low wage increases means that Japanese consumers have had negative real incomes since early 2022, and it is extremely difficult for companies to pass on higher costs through higher prices.

But compared to my previous trip to Japan in the fall of 2023, the economy is showing some positive trends – driven in no small part by a surge in tourism. While the weak yen is certainly a headwind for U.S. beef, the silver lining is that it makes Japan a very attractive travel destination.

In March, the number of foreign visitors entering Japan topped 3 million for the first time in a single month, climbing nearly 70% year-over-year to 3.08 million. The previous record, just under 3 million, was set in July 2019 – about eight months before COVID-related travel restrictions were imposed. Spending by overseas travelers is on a record pace in 2024, reaching 1.75 trillion yen ($11.3 billion) in the January-March quarter, according to the Japan Tourism Agency. This was on full display during my time in Japan, with many hotels sold out and restaurant traffic at the highest levels I’ve seen since before COVID.

This surge in foreign visitors has had the biggest impact on what I would call the middle tier of Japan’s foodservice sector. Yakiniku restaurants, for example, are seeing solid traffic and this is reflected in the market’s strong demand for U.S. outside skirts and tongues. These items are seeing increased competition from Australia. But even with its production and exports rising, Australia doesn’t have enough volume to meet this sector’s need for skirts and tongues.

So Japan has continued to import more from the U.S., at higher prices, with a preference for our grain-fed product. Demand for these items also benefits from import duty rates (2.5% for tongues and 3.2% for skirts) that are much lower than the high rate of 22.5% of beef muscle cuts. Tariffs for all items have been reduced through the U.S.-Japan Trade Agreement, and notched down to these current levels on April 1 with the start of Japan’s fiscal year. Without that critical agreement, which entered into force in 2020, all U.S. beef would be at a tariff disadvantage compared to major competitors.

USMEF. Through March, Japan’s imports of Australian beef increased significantly while shipments from the United States trended lower.

The U.S. beef industry has also seen several successes in family-style dining, including with cuts from the round primal. The Philly cheesesteak concept has gained traction in Japan, and these restaurants are primarily utilizing the U.S. shoulder clod. Supermarkets are also featuring much larger ready meal segments. This trend builds on the success we have seen in Japan’s convenience stores, where U.S. beef is incorporated into bento box ready meals. With U.S. beef supplies tightening and prices for short plate increasing sharply, alternative cuts are attracting increased interest from Japanese buyers who serve these sectors. This is an exciting development, as I believe demand for these products will endure well after Japan’s purchasing power rebounds.

Having access to Japan for beef from cattle of all ages is also an important factor, as ribeyes and other middle meats from older cattle are attractive options for buyers in this environment. Although Japan lifted the 30-month cattle age limit on U.S. beef in 2019, these cuts are still relatively concept to many in the trade because the COVID pandemic disrupted activities such as educational seminars and food shows. But the U.S. Meat Export Federation has been making up for lost time, featuring these items prominently at promotional events. In fact, beef from older cattle and alternative cuts from the round and shoulder clod recently attracted great interest from buyers at two of Japan’s largest food shows – Supermarket Trade Show and FOODEX.

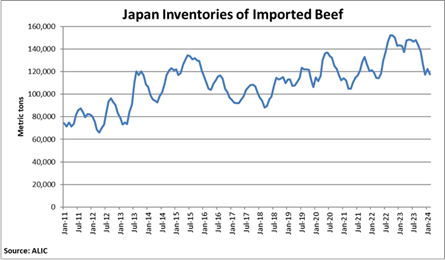

Another encouraging trendline in Japan is the recent decline in beef inventories. At the beginning of March, Japan’s inventories of imported beef were down 17.5% year-over-year to about 118,000 metric tons. This was similar to the December 2023 inventory level, but otherwise the lowest since April 2022. These lower inventory levels represent opportunities for U.S. beef, especially with the surge in tourism generating optimism among buyers. But heightened competition from Australia is definitely an obstacle, as Japan’s first-quarter imports of Australian beef and beef variety meat were up 32% from a year ago, reaching 57,812 mt.

USMEF. Through February, Japan’s imported beef inventories were down nearly 18% year-over-year.

Japan’s foodservice sector is also dealing with a very difficult labor market, which is placing increased pressure on menu prices. Beef bowl chains, for example, a longstanding mainstay for U.S. short plate, have had to make a series of difficult pricing decisions as they try to maintain profitability while still catering to a very price-conscious customer base.

In summary, I see a Japanese market that is far removed from the record-breaking levels U.S. beef achieved there just two years ago, when U.S. production was at a record-large level and Japanese consumers’ purchasing power was much more robust. It will be some time before we see that peak business climate again, but I am confident that it will return. Japan’s consumers greatly value the outstanding dining experience U.S. beef delivers, and this is what made Japan such an outstanding market through years.

The challenge for the U.S. industry is to continue to deliver high-quality U.S. beef and to position our product above the competitors, including through imaging up to the steakhouses that rely on and heavily feature U.S. beef. USMEF-Japan also continues to work closely with buyers from all sectors to help deliver product solutions that meet the needs of their clientele. If we stay committed to these goals and continue to invest in the Japanese market, it will remain a destination that delivers excellent returns for the U.S. industry.

About the Author(s)

You May Also Like