Farm Business Management

More Topics

Farm Progress America, April 25, 2024

Farm Business Management

Farm Progress America, April 25, 2024Farm Progress America, April 25, 2024

Mike Pearson takes a look at the #harvest24 in South America, primarily Argentina and what it has brought producers there.

Subscribe to Our Newsletters

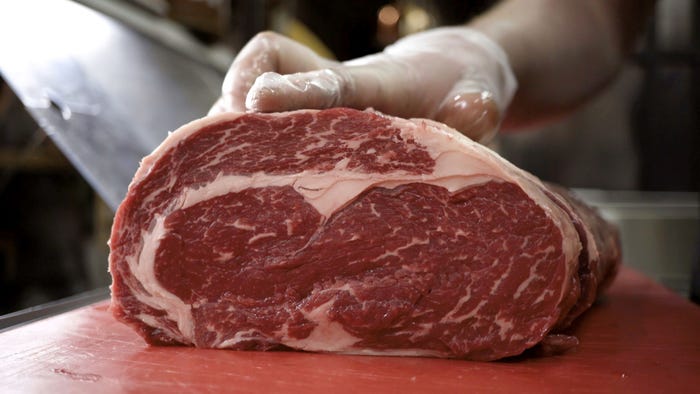

BEEF Magazine is the source for beef production, management and market news.

.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)