The September fed cattle market can only be classified as brutal.

October 6, 2016

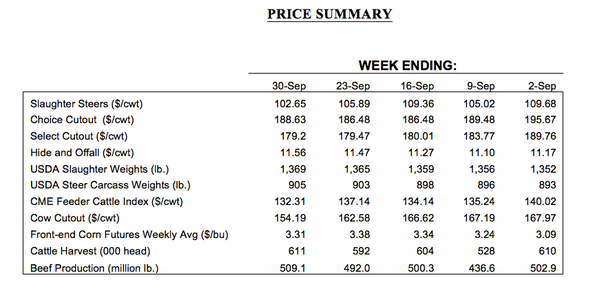

One step forward – two steps back: that was the feel of the fed cattle market in September. After retreating to $105 per cwt following Labor Day, cash fed cattle managed to rally to $109-110 in the middle of the month. At that point, many analysts were calling the bottom. The sharp reversal off the $105 trade lent some credibility to the bottom being in; the market was finally poised to regain some ground.

However, market timing is nearly impossible to predict – especially when it comes to calling a bottom. Therefore, jumping in or standing firm in negative-trending markets can be frustrating. Worse yet, it can be expensive. And unfortunately, the $109 trade proved to simply be a head fake.

Fed trade fell back to $105-106 the following week. And then ended the month on a particularly ugly note as cattle feeders garnered only $102-3. Many cattlemen and traders found themselves swimming upstream amidst that market action during the last half of September. The call for a bottom hung some sellers (on both the fed and feeder side) as they waited for more money, thus recalling last month’s reference to catching a falling knife.

The market now finds itself trading at levels not seen since late 2010-early 2011 (Figure 1). Since the high scored in November 2014, fed cattle have given up $69 per cwt over the course of just 22 months - equivalent to a monthly loss of about $45 per head. Moreover, chart damage has been severe: fed trade previously found support roughly around $115 – that could now prove to be resistance.

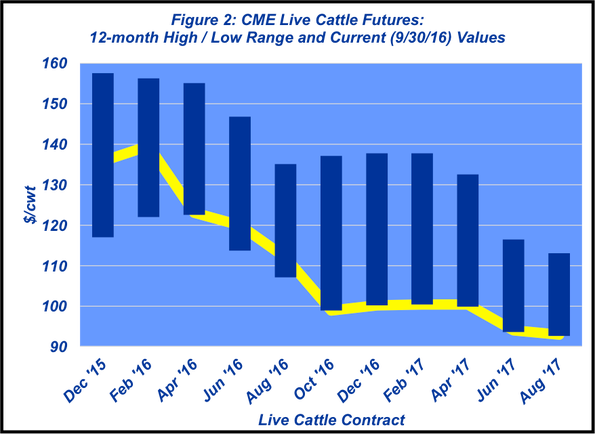

There’s a lot of lifting required to get fed cattle back up to $115 or $120 on a sustainable level. That perspective is underscored by trade at the CME. Deferred live cattle futures contracts are trading largely in the low $100s (Figure 2). In the meantime, the market needs to establish some type of base to prevent further erosion to the downside. Sideways chop and reduced volatility would be a welcome reprieve for most anyone on the selling side.

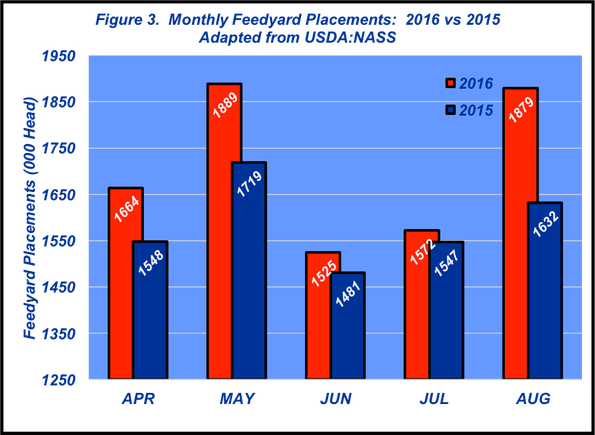

Looking ahead, there’s also the enduring pressure of bigger supplies. Despite sharp losses, cattle feeders have been actively selling cattle. The front end of the fed cattle supply remains manageable. However, that could tip the other way fairly quickly given the continued large number of placements in recent months.

Placements during April through August total 602,000 head more than 2015 – including an additional 247,000 head in August alone (Figure 3). The front end of those placements will be scheduled for marketing in late September and early October. Analysts will be monitoring weekly throughput closely; the pipeline could clog pretty quickly if marketings don’t remain fairly active through the fall.

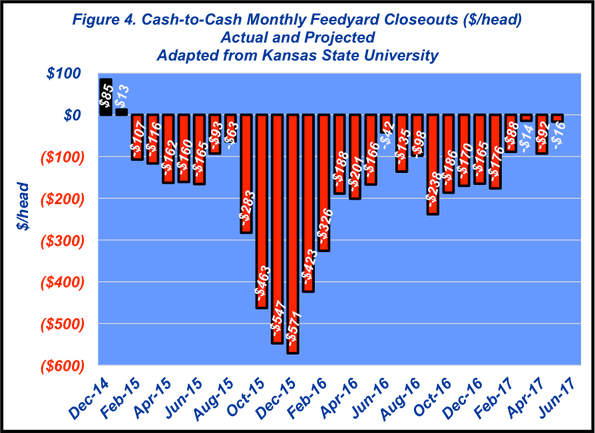

As alluded to earlier, the market is having a key influence on profitability. From a feedyard perspective, cash-to-cash closeouts have now been in the red for over a year and a half – and on average, those losses have exceeded $225 per head during that time (Figure 4).

Worse yet, there’s not much light at the end of the tunnel. Projections are unfavorable going forward, too. At some point, that influence will begin to have a real effect on liquidity and access to capital in the feeding sector.

In light of current losses in the feeding sector, financial pressure could work its way back upstream even more sharply than what’s been experienced to date. This week’s Industry At A Glance illustrates the spread between the current feeder cattle market and deferred fed futures. The difference remains fairly sizeable from a historical perspective. Prolonged losses, continued volatility and liquidity concerns will likely reduce the risk appetite within the sector and could pressure feeder prices even more drastically than what’s been witnessed thus far.

Meanwhile, that influence is already making its mark on the outlook for the cow-calf sector. That’s best described by LMIC’s recent headline: “Estimated Cow-Calf Returns Lowest Since 2009.” LMIC explains that it has, “…consistently ratcheted-down estimated cow-calf returns this year as forecast calf prices for the fourth quarter were lowered.”

LMIC further notes that:

“As of late September’s revisions, the LMIC’s 2016 estimate was a return over cash costs plus pasture rent of about $15.00 per cow, which is the lowest since 2009. That is a huge one-year decline of about $285.00 per cow (2015 was about $300.00 per cow) and was even more disappointing when compared to 2014’s record high level (about $550.00 per cow).

Returns this year will not cover the total economic costs for most cow-calf operations. While estimated costs of production have decreased slightly in 2016, based on cheaper fuel, feed, and slight drops in pasture cost, it has not been enough to offset declining calf prices. Huge returns in recent years provided the economic foundation to aggressively grow the U.S. beef cowherd. The economic stage has quickly changed, but the adjustment in cattle numbers is just starting.”

In summary, September was particularly brutal for the market. Market rallies seem hard to come by right now. Unfortunately, markets like these can prove very emotional. As noted every month, in that type of environment, producers are encouraged to be especially vigilant, disciplined and objective about every aspect of their business to ensure successful decision making.

Nevil Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

You might also like:

Young ranchers, listen up: 8 tips from an old-timer on how to succeed in ranching

13 utility tractors that will boost efficiency in 2016

Burke Teichert: How to cull the right cow without keeping records

3 weaning methods compared; Which one rises to the top?

6 tips for proper electric fence grounding

9 things to include in your ag lease (that you better have in writing!)

About the Author(s)

You May Also Like