thumbnail

Livestock Management

Comparison of beef calves in conventional or natural systems for backgrounding and finishingComparison of beef calves in conventional or natural systems for backgrounding and finishing

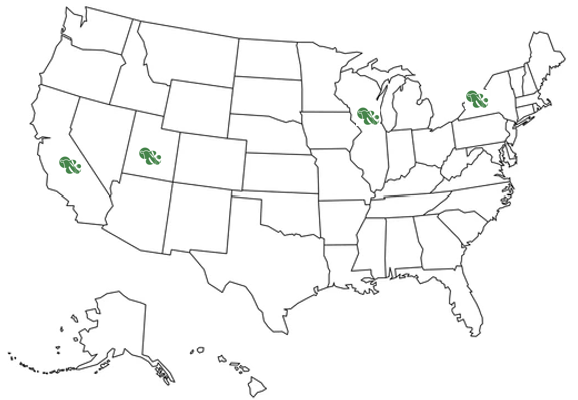

The beef industry is weighing the options between conventional and natural production systems due to consumer demand for natural products. A recent study in Applied Animal Science offers guidance for producers.

Subscribe to Our Newsletters

BEEF Magazine is the source for beef production, management and market news.