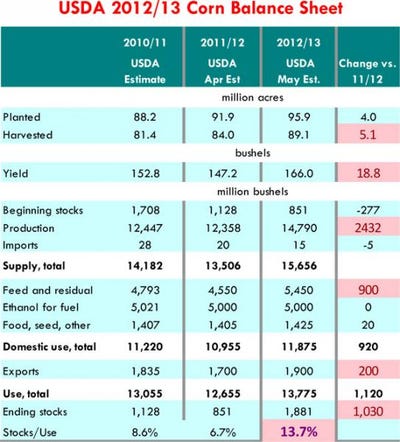

USDA’s latest supply/demand report projects a 6.1% jump in harvested acres for corn in 2012, and a 12.8% increase in expected yields. That amounts to a record 14.8 billion bu., which is 20% larger than the 2011 figure, and would best the current record by 1.75 billion. bu.

May 11, 2012

According to the latest USDA supply/demand update, U.S. farmers this fall will harvest the largest corn crop on record.

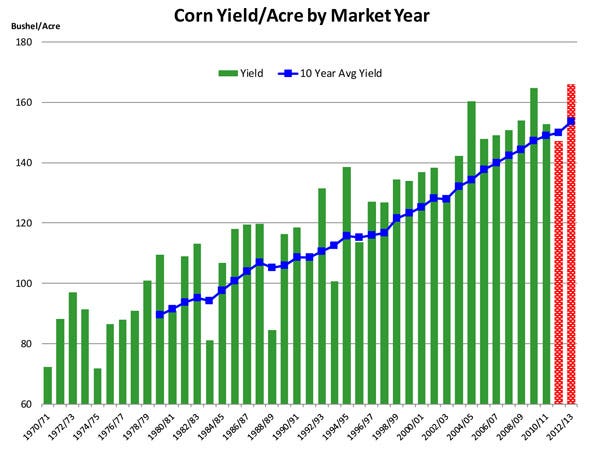

Between a 6.1% increase in harvested acres (5.1 million acres more than a year ago) and a 12.8% increase in expected yields (18.8 bu./acre higher than in 2011), U.S. corn production for the 2012/13 marketing year is now pegged at a record 14.790 billion bu. This is 2.432 billion bu. or 20% larger than a year ago and about 1.75 billion bu. larger than the previous record year output in 2009/10.

USDA was quite aggressive in its estimates for the new corn crop but its data follow established methodology whereby USDA analysts account for crop progress so far this year and adjust their trend yields accordingly. With planting progress well ahead of schedule so far this year, and weather forecasts indicating the La Nina weather pattern is coming to an end, USDA now expects above trend yields this fall. Some analysts continue to wonder how realistic this assumption is.

The sharp expansion in corn plantings has brought more marginal and lower-yielding acres into the mix. While U.S. farmers have approached current yield estimates in the past, indeed yields were 165 bu./acre in 2009/10, that yield was from planting 86.4 million acres, compared to 95.9 million acres this year. It would appear to us that for current yield estimates to materialize, a lot of things need to be just right for this year’s corn crop. So far, things are shaping up well but Mother Nature still holds all the cards.

One surprising twist in the supply-and-demand table was that USDA also increased projected ending stocks for old crop corn. This ran counter to estimates by most analysts’, who expected old crop ending stocks at around 750 million bu., compared to the 851 million bu. that USDA reported.

One surprising twist in the supply-and-demand table was that USDA also increased projected ending stocks for old crop corn. This ran counter to estimates by most analysts’, who expected old crop ending stocks at around 750 million bu., compared to the 851 million bu. that USDA reported.

USDA reduced feed-consumption estimates for this summer as more wheat is currently going into livestock and poultry feed. USDA also didn’t change its estimates for U.S. corn exports despite much talk in the trade of large shipment to China and other destinations. Demand estimates for the new crop were equally interesting and different from what private analysts were contemplating ahead of the report.

USDA sharply increased U.S. corn-feeding estimates in the new crop year, projecting feed and residual use at 5.450 billion bu., about 900 million bu., or 13.7%, higher than a year ago. This feeding level would imply a notable decline in wheat feeding, as corn/wheat spreads widen and also expansion in livestock and poultry numbers.

With the calf crop declining in the next year, cattle feed demand will remain limited, and likely will contract. Some hog expansion is expected but, based on current farrowing estimates into year end, it is unlikely we will see more than a 1% increase in hog numbers at least through Q1 of next year. Maybe the broiler industry will make a sharp U-turn and expand rapidly. There are some indications that broiler supplies will recover by Q4.

Lower corn prices certainly are an inducement but keep in mind that, for poultry producers, soybean meal prices are very important, accounting for as much as 30% of the broiler ration. Soybean meal prices have increased sharply in recent weeks and are expected to stay high into next year as well.

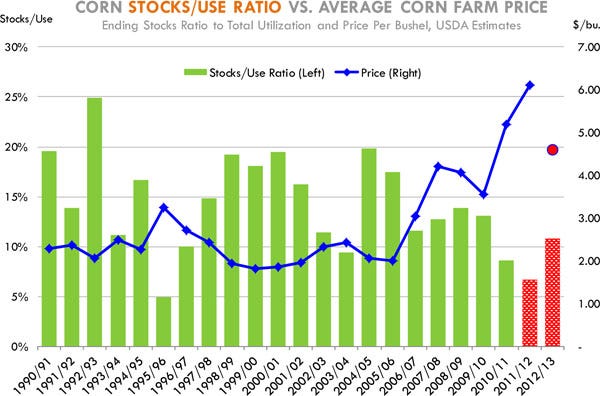

But even as some analysts think the feed estimates overstate the case for demand next year, they also believe the current USDA export estimate may be on the low side, especially if Chinese producers fail to produce another record crop. A potential increase in exports could offset lower feed numbers. USDA now expects the stocks/use ratio to double in 2012-13, pushing prices in the $4.5/area.

You May Also Like