2015 feeder cattle market is a tale of two trends.

November 5, 2015

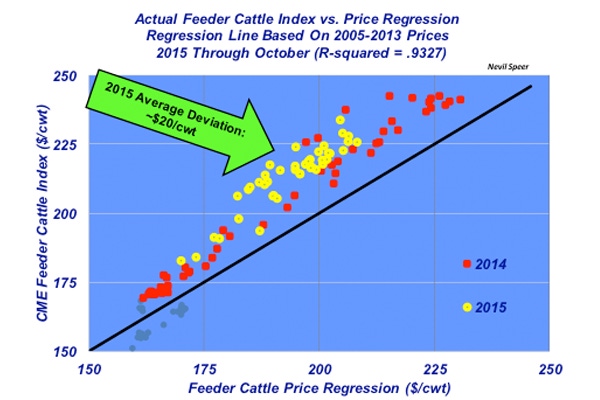

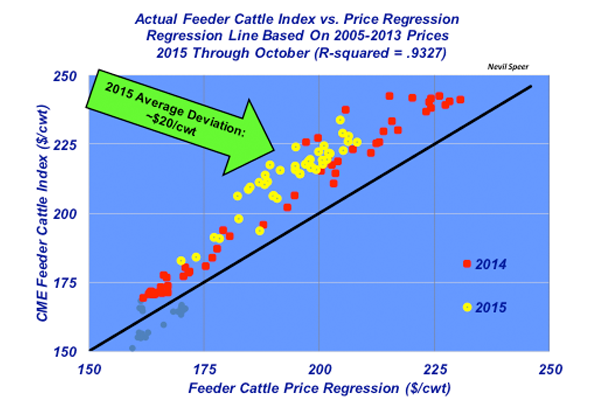

This week’s chart provides some perspective of feeder cattle pricing trends in 2014 and 2015 versus the historical expectation. Prices on the horizontal axis represent predicted feeder cattle prices based on data between 2005 and 2013. Meanwhile, feeder prices on the vertical axis reflect the actual CME Feeder Cattle Index.

That relative comparison is based on the relationship between predicted (derived via statistical regression) versus actual price. The regression is comprised of nine years’ worth of data (2005 through 2013) and possesses an r-squared value of 0.9327; in other words, more than 93% of the weekly variation in feeder cattle prices can be explained by the statistical regression.

First, let’s start with 2014. The strength of the 2014 feeder cattle market was unprecedented. From a historical perspective, feeder cattle were purchased ahead of expectations every week of the year. Subsequently, 2014 predictions vs. actual prices are also represented in the graph. Data points above the line represent prices higher than expected. Most importantly, every week in 2014, the CME Feeder Cattle Index has finished above the predicted value. The average deviation in 2014 was $12.50 per cwt.

Now, let’s turn our attention to 2015. The pattern is the same: 2015, like 2014, has resulted in a positive deviation every single week thus far in the year. From a long-run perspective, cattle feeders have priced replacements aggressively in 2015. In fact, this year’s average deviation is nearly $20 per cwt – or about $150 per head – above the expectation. That’s $7.50 per cwt (or $55 per head) more versus 2014 pricing trends.

Now, let’s turn our attention to 2015. The pattern is the same: 2015, like 2014, has resulted in a positive deviation every single week thus far in the year. From a long-run perspective, cattle feeders have priced replacements aggressively in 2015. In fact, this year’s average deviation is nearly $20 per cwt – or about $150 per head – above the expectation. That’s $7.50 per cwt (or $55 per head) more versus 2014 pricing trends.

However, negative closeouts are beginning to creep into the feeder market. The biggest deviation occurred early in the year: January 2015 witnessed deviations as large as $29 per cwt and this, along with a weaker fed market, explain much of the current feedyard profitability challenges. The deviations have since wound down to around $6-8 per cwt in late October.

At what point would you expect feeder cattle pricing to get back in line with historical expectations – if ever? Will the magnitude of closeout losses in the second half of 2015 get further pressed into the feeder market in late 2015? How might the current trends described above shake out going forward in terms of competitiveness in the feeder cattle market? What are your expectations for the feeder market going forward? What influence might weaker feeder cattle prices have on expansion plans in 2016 and beyond?

Leave your thoughts in the comments section below.

You might also like:

Gallery: A waterer that never freezes? It's true!

Is the cattle market whiplash over?

What's ahead for 2015 on the cow-calf side?

Enjoy a laugh on us! Holmes and Fletcher classic ranch cartoons

Burke Teichert: How to build better land and soil

About the Author(s)

You May Also Like