After a devastating September, the October fed cattle market was a ray of hope. What will the rest of 2015 hold for the fed cattle market?

November 12, 2015

September’s market plunge might best be likened to an artillery barrage—while it’s occurring, the only thing to do is hunker down and wait out the siege. Conversely, October allowed some reprieve from the shelling and provided cattle feeders opportunity to get back on offense.

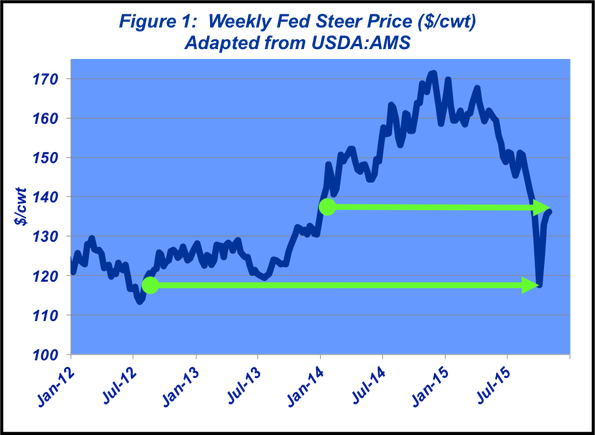

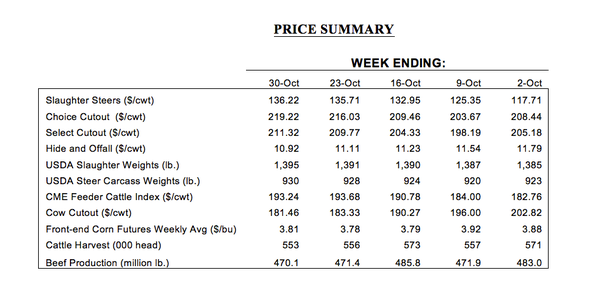

As review, the fed market finished September at $117-118 per cwt – retreating $27 per cwt (or about $375 per head) during the month. October’s story is much better. Feedyard managers were able to reverse the negative momentum. They earned back at least part of September’s decline; cattle trade marched back up to $136 in just four weeks (Figure 1).

But with the battle analogy in mind, now comes the time to assess the damage and strategize going forward. So, while the market has improved, there remain challenges ahead. Fundamentally, that comes on the beef side.

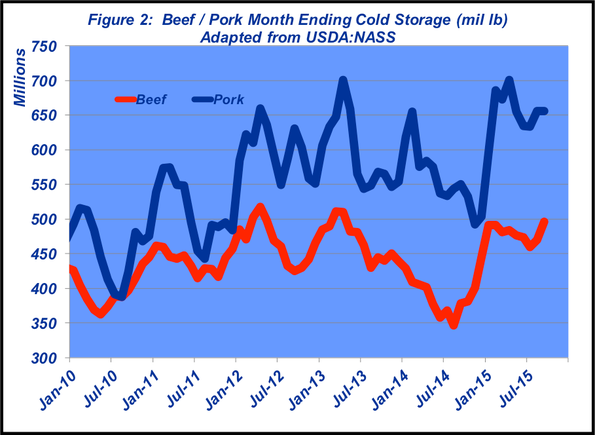

October’s cold storage report perhaps highlights what might be the largest upside limiting factor in the months to come. Meat supplies at the end of September were up across all categories—beef, pork and chicken. More specifically, beef stocks totaled nearly 497 million pounds – a new record for September and 31% bigger versus 2014 (Figure 2).

Meanwhile, the October Cattle on Feed report also indicated work remains to prevent another volley of sharply lower prices. USDA’s October 1 feedyard count was 10.22 million head – ahead of both 2014 and 2013 levels. Moreover, the front end remains sizeable. Cattle on feed more than 120 days equaled 3.81 million head – the lowest level since February, but 325,000 head more than last year. This establishes the highest mark for October in the series.

Front-end pressure won’t likely let up anytime soon, given the current propensity to place heavy cattle. The market has made both buyers and sellers reluctant participants – each fighting the market in their own way. Specific to the feeding sector, though, cattle are being fed longer; thus feedyards have pinched down purchasing replacements and/or delayed arrival of previously-purchased cattle. That reality only serves to hamper upside potential for the market in late fall-early spring, and confounds the presence of larger meat supplies in cold storage.

All that said, September placements were the heaviest on record; that’s the direct result of cattle weighing more than 800 pounds comprising nearly 43% of all arrivals, (also a new record. So, September is yet another month of placement bias to the heavier end—during the past six months, 800 plus pound yearlings account for nearly 41% of total placements). From a broader perspective, the trend of late is a significant uptick from a longer-running trend emphasizing arrival of bigger cattle.

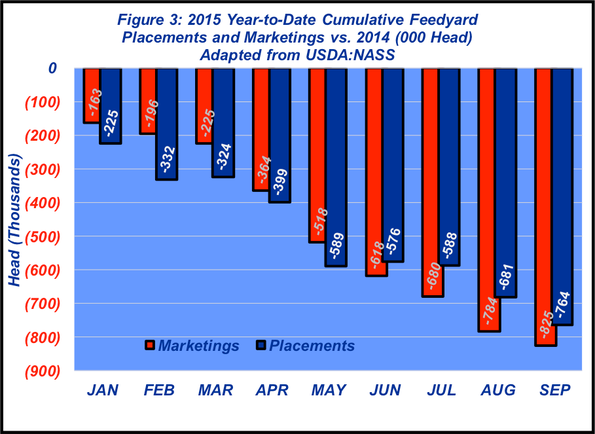

As alluded to earlier, consistent with trends throughout 2015, both buyers and sellers are reluctant participants within the current market environment. That’s demonstrated by slower placements coming in and delayed marketings going out (Figure 3). Cattle throughput is lagging, the outcome being reinforcement of the old adage – heavy in, heavy out. To that point, slaughter weights and steer carcass weights continue to surge into record territory, finishing October at 1,395 pounds and 930 pounds, respectively.

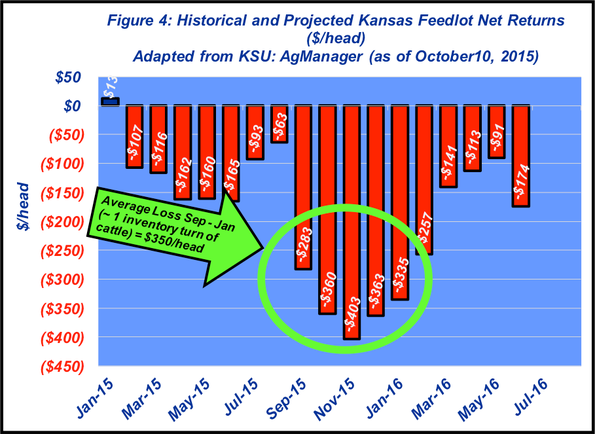

Most importantly, the dynamics around placement and marketing behavior is, at the core, fundamentally indicative of feedyard profitability. Closeouts are unprecedentedly tough. Last month’s market confounded already-challenging closeouts. As of mid-October, Kansas State University indicates negative closeouts, at current deferred futures levels, will continue well into 2016. More significantly, from a near-term perspective, losses will approach $350 per head in the coming months (Figure 4).

It’s those losses that highlight the challenges in terms of managing the buy. First, negative closeouts mean negative return on inventory investment. But second, it’s more than just the fed market that’s causing the damage – it’s a weak fed market occurring against high-priced placements.

Despite the losses documented above, cattle feeders continue to price cattle above expectations; the 2015 average deviation is nearly $20 per cwt – or about $150 per head – above historical norms established between 2005 and 2013.

The pushback in any discussion around feedyard losses is predicated on the calculation being a cash-to-cash calculation. What about risk management? That’s an important consideration. However, recent market patterns have confounded risk management strategies in the recent downturn. That is, 2013 and 2014 established some false sense of security.

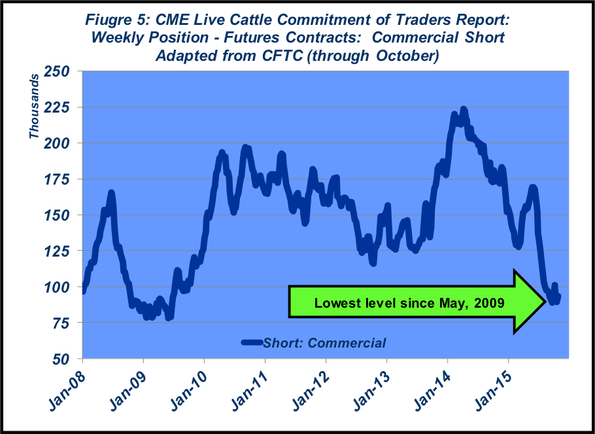

During the past several years, the options strategy of purchasing puts largely proved to be an unnecessary insurance cost. Simultaneously, at the time of purchase, favorable hedging strategies were difficult to come by at time of placement (who wants to hedge a loss?), and/or carried high opportunity cost as the cash market surged to new highs. The outcome being that within the recent round of closeouts, the relative breadth of market price protection has likely caught many feedyards upside down – as indicated by the sharp decline in commercial short volume during the past several years (Figure 5).

The takeaway is that equity drain for feedyards in 2015 is unparalleled and will require readjustment from an operations perspective. Review and adjustment of business and financing strategies will likely be mandated for most entities – regardless of size or role in the industry. With that in mind, regardless of how the market performs in the coming months, it’s important to reiterate several key reminders from previous columns.

First, “Trying to outguess or outsmart this market is about like trying to outrun a speeding train. It’s nearly impossible to do and the consequences can be devastating. Given the continued pattern within the market, sharp moves are the primary challenge to be managed – both up and down.” And second, “Now more than ever, this market serves as a reminder the importance of access to accurate, data-driven, objective information; and establishing time to adequately absorb and analyze that information. Both components are essential to making successful decisions, amidst the turmoil, over the long-run.”

Nevil Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

You might also like:

WHO backpedals on red meat/cancer link

65 photos that celebrate cowgirls & cattlewomen

5 tips for getting the most cash for your cull cows

3 steps to negotiating a great cow lease

About the Author(s)

You May Also Like