Cattle feeders have remained fairly aggressive when buying replacements.

September 4, 2014

Given the cattle market action from May through July, it almost seemed as if there was no stopping the bull run in the cattle market. Reality set in during August, however, with live cattle prices being subjected to a consolidating trend.

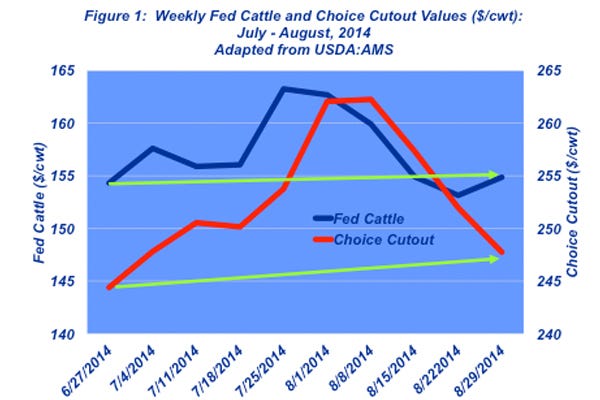

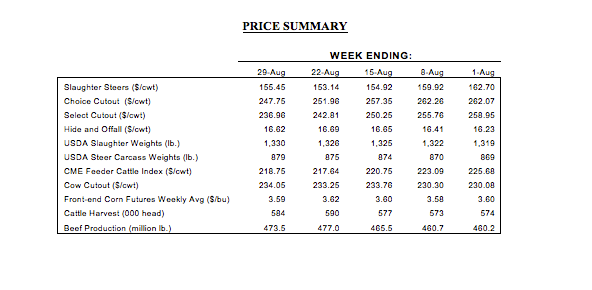

From a broad perspective, the August average was nearly identical to that established in July ($157 and $158, respectively). The averages, however, don’t really tell the whole story. More important are the details underneath the market, including the back and forth between the fed market and cutout values. And, after all is said and done, we’re back to where we were two months ago (Figure 1).

Stating July’s average at $158/cwt. overlooks the monthly peak of $163 and the $9/cwt. gain during the month. Similarly, August’s $157 average neglects the descent on the other side, as August gave up nearly $8 from the July-ending $163 to close at $154. Playing that out for a 1,350-lb. steer represents about a $230 swing/head ($120 up in July, and $110 down in August) over the course of just eight weeks.

Meanwhile, packers have faced the same challenge (albeit the timing worked to their favor in the past month). The Choice cutout started July at $247/cwt., after which wholesale beef prices surged to pull value all the way up to $262 during the first several weeks of August. That represents an increase in carcass value of approximately $125 for the same 1,350-lb. steer. However, during the past several weeks, boxed-beef prices have been under pressure, receding back to $247 as August closed business.

As referred to above, packers were able to play the swings to their advantage. Fed cattle prices were declining, while beef prices were improving in early-August, which allowed processors to score a run of several highly profitable weeks. Gross margin estimates averaged approximately $240 through August.

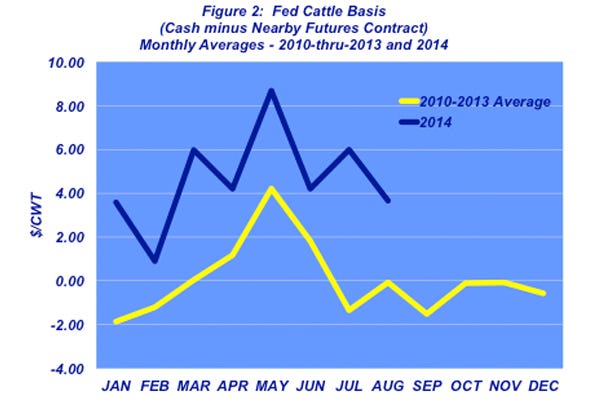

The inherent question within the weekly noise surrounds bargaining and marketing strategies. That is, why would feedyards give up so much leverage and sell into that type of scenario? That invokes a secondary consideration for cattle feeders: managing basis. Throughout 2014, basis (cash minus futures) has been strongly positive (Figure 2).

In fact, July basis was over $7 ahead of the 2010-2013 average. Meanwhile, August basis ran nearly $4 ahead of the average. Risk management strategies are typically predicated on historical basis trends; strong basis encourages active marketing into the pricing environment. Given that consideration, cattle feeders become increasingly indifferent to the week-to-week back-and-forth with the packer, and much more willing to sell into positive basis.

Future cattle market possibilites

Looking ahead, several factors are critical:

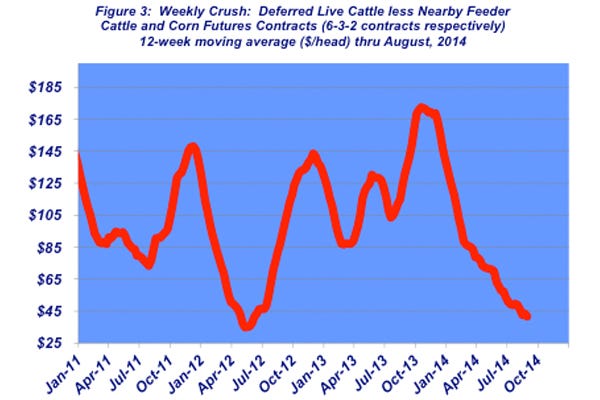

First, cattle feeders have remained fairly aggressive when buying replacements. The feeder market has remained within a solid trading range of $215-$220 during the past six weeks. However, during that time, the deferred fed cattle futures against which those cattle are placed has transitioned from December to February. That’s sharply changed the profitability picture for current placements.

For example, at the end of July, replacements were being priced against the December contract – trading $157-8 at that point. Fast forward to now, most deliveries (priced similarly) are placed against the February contract currently trading $151-2. That represents a sharp bite out of potential profitability and extends a streak of ever-tightening swaps throughout the year (Figure 3). There will need to be some upside in the fed market and/or another leg down in the corn market to make current arrivals turn a profit.

Second, for fed cattle to actually trade back up to $160 again in 2014 will likely require another strong run in cutout values. However, that shouldn’t be too much of an uphill climb. The comprehensive cutout typically stages a $5-7 seasonal rally from August through December.

Therefore, the market may be positioned well for some further upside later in the year. That could pull the early-spring market with it and help provide some buffer for the current round of feeder cattle purchases.

All that said, as noted last month, “Trying to outguess or outsmart this market is about like trying to outrun a speeding train. It’s nearly impossible to do and the consequences can be devastating.” And also noted, “…price volatility remains a major burden for those in the market every day and every week.” Producers and traders are encouraged to position carefully given beef’s current navigation into uncharted territory. With that, it’s always important to remind ourselves of the importance of objective information and disciplined review. Both are essential to helping ensure successful decision-making going forward.

Other trending headlines at BEEF:

100+ Photos Of Our Favorite Ranch Dogs

How Drones May Change Food Production From Pasture To Plate

Why Is Death Loss Increasing In Heavier Beef Cattle?

Readers Share Their Favorite State Fair Memories

Photo Gallery: 10 New Farm Trucks To Consider For 2014

Why The Movie Noah Upset This Rancher

Feedlot Tour: Triangle H Grain & Cattle Co.

About the Author(s)

You May Also Like