Lots of unknowns remain heading into 2016. Thus, volatility will likely remain with us for the foreseeable future.

January 7, 2016

Out with the old, in the with new: anyone involved in the cattle business likely celebrated New Year’s Eve with a little more anticipation and fervor than normal. The business is glad to see 2015 come to an end, with hopes that 2016 will bring, at the very least, a little more stability and predictability.

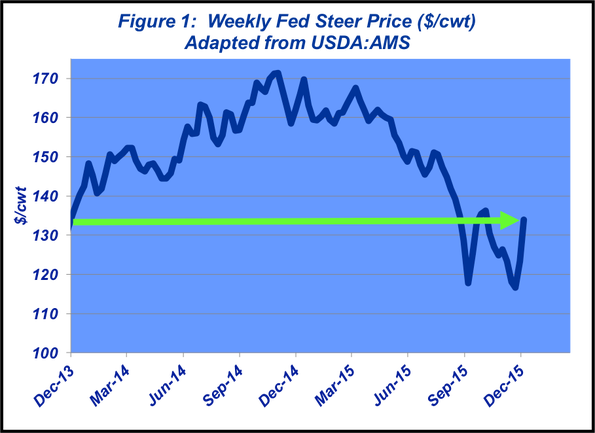

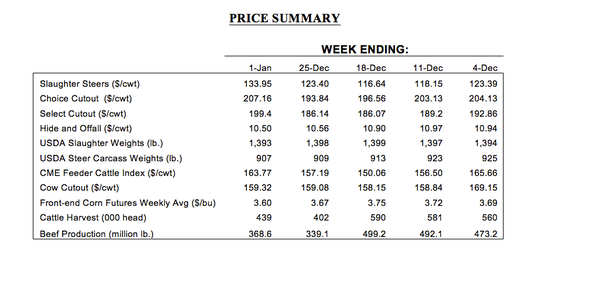

To that end, 2015’s theme was volatility. And unfortunately, the swings from week to week were rarely favorable. The fed market started the year at $165-166 and managed to reach $167-1688 in early April. But from there, it was all downhill – grinding lower until the fed market bottomed at $118 in late September. Bottom line: in the span of just six months, fed trade retreated $50 per cwt – the equivalent of $650-700 per head (Figure 1).

During the past several months, though, the hardest thing to deal with has been the sharp moves – mostly down but some up, too. Accordingly, the year’s close at the CME was an appropriate sign-off with a definitive weather rally along with some short-covering. December live cattle went off the board at $135.80 – adding nearly $19 per cwt from the $117 low established just two weeks prior. Meanwhile, cash trade ended the year at $134. Interestingly enough, that was just about even with trade from two years ago.

In talking with producers in recent months, the question that often arises goes something like, “What happened in 2015 that’s made it so different from 2014?” There’s not an easy answer to that question. Nevertheless, 2015 is marked in the books and some review from a broad perspective is important to understand how it all unfolded.

There were several indicators along the way. That’s especially true looking back over the last twelve months. This column noted last January that:

The potential for substantial, and unexpected, moves requires constant vigilance and persistent monitoring. And the “all-alert” is probably most prudent just when everything seems predictable or orderly. That reality is best witnessed by market action in the cattle markets during the past month [December, 2014].

Recall that November fed trade finished the month at $171 per cwt, established several new record highs during the month and managed to average nearly $170 per cwt. But just as quickly, the market’s sustained run of better prices came to end as December opened for business. Over the span of just three weeks, the market retreated nearly $13 to settle back at $158 just prior to Christmas.

So, the market was sending some signals that all was not well. That was especially true looking at the action around the deferred contracts as 2014 closed for business. Here’s more commentary from a year ago:

Equally important, the deferred live cattle futures also gave up ground. The February and April contracts have both gone from trading $169-170 at the end of November to trading $159-160 during the Christmas holiday week. The slide possesses some especially important implications. Primarily, cattle feeders that haven’t hedged fall run purchases, on hopes of a spring rally, now have a deeper hole to dig out of.

Finally, and most importantly, there was the building wall of cattle and concerns about uncurrentness. That was this column’s perspective in January, ’15:

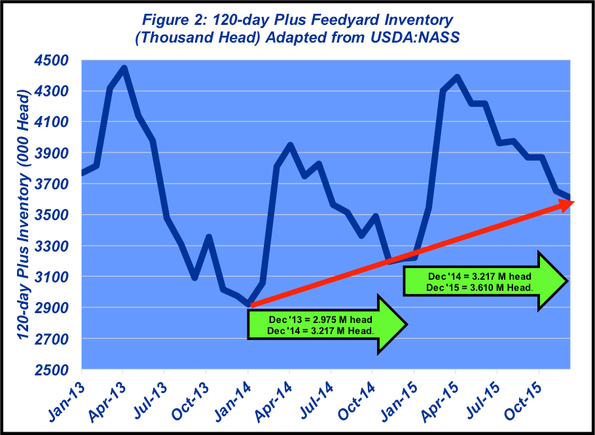

[The hole that cattle feeders must dig out of] is compounded by the fact that cattle weights are running well ahead of last year plus the 120+ day feedyard inventory is sizeable. USDA’s December Cattle on Feed report placed the number at 3.302 million head - the second-largest level in the series history behind 2012…feedyards currently possess good leverage as packers chase cattle, the front-end supply will need to be monitored carefully going into 2015.

And that’s really where the wheels began to fall of the wagon. It was uncurrentness that fueled volatility and took the market to lows unforeseen by even the most astute of analysts.

It’s been a long time since the feeding sector has had to grapple with a big front-end of cattle. And once cattle feeders get behind in marketings, and closeouts become perpetual losers, negative momentum begins to build and feeds itself in a downward spiral. It’s a buzz saw that chews up everything in its way. That’s precisely where we found ourselves in the throes of 2015.

All clear? Not yet

While the market seems to have settled down during the past month, the “all-clear” hasn’t been sounded. First, the front-end remains sizeable. December’s Cattle on Feed report pegged the inventory of 120 day-plus cattle at 3.610 million head; while down from the previous month, it’s the largest December mark in the series history (Figure 2) – and continuation of a similar trend in late 2014 leading into 2015.

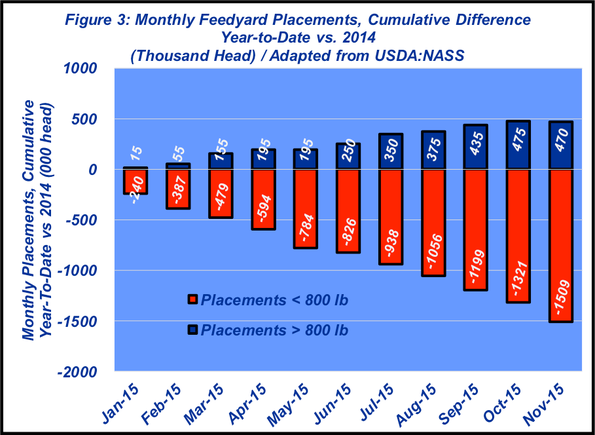

Second, that’s confounded by placement patterns. The heaviest weight category of placements (800-plus pounds) is the only delineation in which arrivals are running ahead of last year’s pace (up 470,000 head through November).

Cattle are staying out of the feedyard until they have to move; placements of cattle weighing 799 pounds or less are down over 1.5 million head through November. But that pattern sets the sector up for heavy cattle to continue being delivered through spring. The pipeline remains stacked for big weights and little wiggle room when it comes to marketings – heavy in, heavy out (Figure 3).

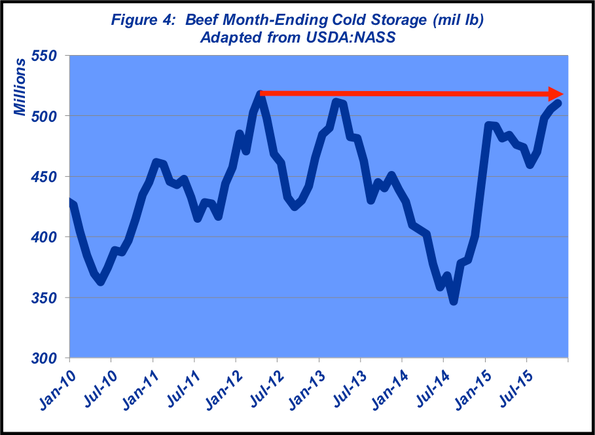

Third, there’s the ongoing backdrop of big meat supplies heading into 2016. That’s been an enduring theme during the past several months. USDA’s cold storage report indicates November beef inventories at 510.5 million pounds – 27%, or nearly 110 million pounds larger versus November 2014. Moreover, that mark is the second largest in series history, trailing only March 2013 by only 751,000 pounds (Figure 4). The meat side needs to keep product moving to ensure that pipeline doesn’t get clogged up ad prevent exacerbating the ability to market cattle out of the feedyard.

Where all does all that leave us for 2016? That’s the most difficult question to answer. Let’s hope we’ve weathered the worst of the storm. But suffice it to say, gains likely won’t come easily – and sure not like they did in 2014. There’ll be a several key factors that need to be monitored carefully heading into 2016 – including fundamentals discussed above coupled with FOMC monetary policy and strength of the world’s economy during the coming year.

As such, lots of unknowns remain heading into 2016, thus volatility will likely remain with us for the foreseeable future. That’s what made 2015 so challenging; extreme volatility makes decision-making difficult to manage. It introduces not only the concern about protecting against down-side risk, but there’s also the worry about missing upside potential. As noted many times in 2015, “Trying to outguess or outsmart this market is nearly impossible to do and the consequences can be devastating. Given the continued pattern within the market, sharp moves are the primary challenge to be managed – both up and down.”

Given that reality, there’s no precise, one-solution-fits-all scenario to fall back on when markets begin to swing hard and fast like they’ve done during the past several months. However, there are key some principles that can be followed to better prevent getting caught flat-footed.

Although 2015 may feel like it should be a year to forget, there are important lessons to be gained. Markets can be merciless; as such, producers should be, now more than ever, investing time and effort to monitor markets carefully and objectively to ensure successful decision making.

Nevil Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

You might also like:

7 ranching operations who lead in stewardship, sustainability

Why we need to let Mother Nature select replacement heifers

Photo Gallery: Laugh with Rubes cow cartoons

Beta agonists wrongly blamed for fatigued cattle syndrome

Lessons from the 2015 cattle market wreck

Feed and bed your cows without all the waste

A waterer that never freezes? It's true

About the Author(s)

You May Also Like