This spring’s fed market is strikingly similar to last year.

June 4, 2015

Giving full credit to Yogi Berra, 2015 of late seems, “It’s like déjà vu all over again.”

“The market finally hit some speed bumps in April…the setback could have proven to be the catalyst for a major setback in May. That’s especially true given the June live cattle contact has been trading at a strong discount to the fed market. But all that wasn’t to be with the market being very durable during May. This market has proven persistently stubborn...Fed prices are bound to work seasonally lower in the coming weeks and months as we head into summer…[but] it’s not going to happen without a fight.”

The paragraph above is an excerpt from my monthly column last year at this time. The market has behaved the past several months in almost identical fashion to last year.

The column went further to explain that, “Seemingly, there’s a strong tug-of-war occurring around fed cattle trade (at least for the time being). The fed market managed to hold trade together at mostly $144-6 throughout the month of May….The four-week average is now $146 – only $1-2, just $2-3 back of the same measure at the end of April.”

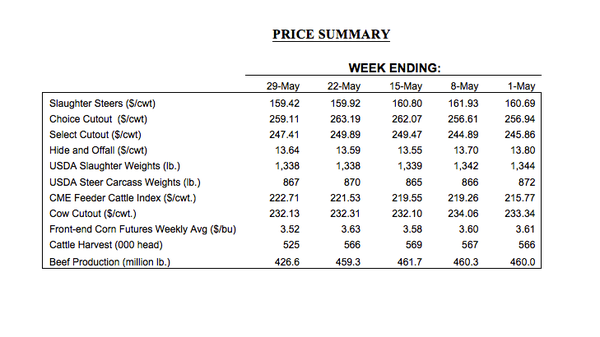

The exact same pattern evolved this year, just substitute the values by tacking on about $15 per cwt. That is, the fed market traded mostly $159-161 through May; the four-week average is now $161 – just $1-2 back of the same measure at the end of April.

What’s more, nearby basis is also behaving similarly. I noted last year that, “…basis has been especially strong in 2014 ($8-10 through most of May versus just $4-5 last year). That’s served as a strong incentive for cattle feeders to keep marketing cattle as aggressively as possible. Strong basis ultimately gets resolved by either the cash market softening or futures markets strengthening (or some combination of both). Clearly, sellers wish against the first solution and hope for the second.”

Per the theme above, that same scenario is playing out in 2015: Basis remains strongly positive as the market transitions into June. That pattern is follow-through of a longer-term trend. Historically, the long-run basis trend was (and should be) mostly flat (at zero). However, that’s not been the case in recent years.

70+ photos showcasing all types of cattle nutrition

Readers share their favorite photos of cattle grazing or steers bellied up to the feedbunk. See reader favorite nutrition photos here.

May’s nearby basis averaged just over $7 per cwt – consistent with 2014, but well above the $4 average established 2010-2013 when the market began its strong surge to the upside. That possesses some important implications for both buyers and sellers – while it’s always been critical, monitoring and managing basis has become an increasingly significant component of decision making.

As noted above, the fed market maintained a tight trading range at $159-161 through May. For the packer, though, what did change was some seasonal upside in the wholesale market just prior to Memorial Day. The Choice cutout established a new all-time daily high at $265.59 on May 19 and a new weekly average record that same week, hitting $263.19. Meanwhile, Choice beef retail prices recorded a new high at $6.40 per pound in April and year-to-date, retail prices are running well ahead of last year’s marks.

As a result, packer margins have taken a positive turn of late. Early April had the comprehensive cutout running closer to $255 while fed steers and heifers were costing $168 per cwt. At the time, spot margins bottomed around $50 per head.

Fast forward to May: add about $60 per head on the cutout side and $100 per head savings on the cattle front and the packer was able to operate a couple of weeks with strongly positive margins. It’s important to note, though, that’s simply a snap shot; the long-term perspective remains very challenging.

Differences in 2015

While the market has behaved similarly to 2014 during the past several months, this is probably where the parallel ends. Looking ahead to summer, it’s unlikely 2015 will repeat 2014’s incredible run. So, the market now begins in earnest to transition to summer with somewhat tempered expectations. The primary question around the trend of weekly negotiations in the months to come will be just how deep the expected seasonal downturn might be.

That will depend largely on beef demand. Beef prices in 2015 continue to surprise to the upside. That inherently invokes some discussion around beef demand trends and its influence on cattle prices. Derrell Peel, Extension livestock marketing economist at Oklahoma State University, describes it well in some recent market commentary:

“Beef demand has continued stronger than many feared as retail prices surged higher over the past 15 months…

BEEF Seedstock 100

Looking for a new seedstock provider? Use our BEEF Seedstock 100 listing to find the largest bull sellers in the U.S. Browse the Seedstock 100 list here.

“There is concern that retail beef prices cannot be sustained in the face of cheaper pork and poultry. Certainly retail price ratios of beef to other meats are at record levels and the feeling is that they must or will revert to more historical levels soon. The evidence is growing that they may not adjust much as long as beef consumption is record low. Beef production is expected to decrease another 1-2 percent in 2015 but increased net beef imports may result in a fractional increase in per capita domestic beef consumption for the year.

“However, beef production will grow only slowly through 2016 and into 2017 and per capita beef consumption may actually drop in 2016 if beef exports recover a bit and beef imports moderate as expected. It appears that beef demand is stronger than expected and the potential for cheaper pork and poultry to limit that is less than expected.”

Whatever happens, the beef business continues to operate with unprecedented capital requirements and higher levels of risk associated with every business decision. That said, consider the all-important closing reminder each month: careful consideration of risk management strategies around both the market and the business is imperative! Moreover, strategic decision making requires investment into acquiring accurate, trusted information and subsequently making sufficient time for disciplined evaluation. Both components are essential to being successful over the long run. "

You might also like:

How to treat leg fractures in young calves

How to prevent & treat pinkeye in cattle

About the Author(s)

You May Also Like