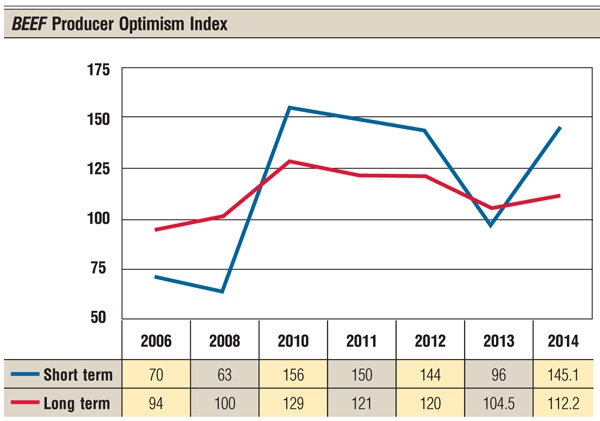

After a sharp plunge in 2013, BEEF magazine’s annual survey of producer attitudes shows a huge leap in optimism for 2014.

“Short-term optimism is up.” That’s how BEEF research guru Scott Grau somewhat understatedly characterizes this spring’s 50-point jump in U.S. beef producers’ attitudes regarding short-term industry prospects. Grau, who conducted BEEF magazine’s annual reader attitude survey, attributes the spike to good fundamentals and a steady succession of record prices.

In fact, Grau says that among the 800 respondents to the April survey, even the 30% still in the grasp of drought, while slightly less optimistic than their counterparts in wetter regions, aren’t doom and gloom.

Optimism is up big-time

Last year, BEEF magazine’s measuring tool of producer attitudes — the Producer Optimism Index (POI) — took a sharp dive to below 96, from 2012’s 144 (POI figure). That was the most dramatic one-year drop in short-term attitudes since the series began in 2006. But the April 2014 survey cataloged short-term POI at 145.1, and readers’ view of the long term also improved to 112.2 from 2013’s 104.5.

When asked, “Compared with last year, what is your current level of optimism regarding the short-term future — within the next two years — of the U.S. beef industry?” almost 50% of all respondents say they’re more optimistic, while 46.5% say their attitude hasn’t changed. Only 4.2% say they’re less optimistic than last year (Figure 1).

When asked, “Compared with last year, what is your current level of optimism regarding the short-term future — within the next two years — of the U.S. beef industry?” almost 50% of all respondents say they’re more optimistic, while 46.5% say their attitude hasn’t changed. Only 4.2% say they’re less optimistic than last year (Figure 1).

These results stand in sharp contrast to the 2013 survey, when 21% of survey respondents described themselves as more optimistic about the industry’s short-term future, 53% said their level of optimism was about the same and 25% were less optimistic.

A look at the regional breakout for 2014 shows the weather effect Grau refers to (Figure 1). Regions with sufficient moisture show much higher levels of optimism than areas still locked in drought. Of the respondents in the East North Central region, for instance, 65.1% say they’re more optimistic, while the South Atlantic (60.7%) and East South Central (62.3%) showed similar results.

However, producers in a big swath of the Southwest and West are showing the wear and tear of the weather. By the same token, they are also showing the toughness and resiliency that characterize cattlemen.

Of the respondents from the Pacific region, 37.5% say they are more optimistic than last year, while 56.3% say they are about the same as in 2013. Only 6.3% say they are less optimistic.

Producers in other regions were more evenly split. The Mountain region registered 45.9% more optimistic, 49.2% about the same and 4.9% less optimistic; the West South Central came in at 45.4% more, 46.7% the same and 7.9% less; and the West North Central showed 46.2% more, 51% the same and 2.8% less.

Far and away, the industry’s supply-demand fundamentals are driving short-term optimism, say 81.9% of all respondents. A tick more than half (50.4%) see increasing international demand as a positive sign, and 49.1% say greater availability of feed and forage is positive in the short run. Numbers add up to more than 100% because of multiple responses (Figure 2).

Of those who are less optimistic, 72.7% overwhelmingly see government regulations and oversight as a concern, while 48.5% cite increased input costs and 39.4% are concerned about consumer demand. Numbers add up to more than 100% because of multiple responses (Figure 3).

Long-term outlook

While record-high cattle prices and moderating feed costs are driving the uptick in short-term optimism, producers are slightly more cautious concerning the long term. BEEF readers were asked, “Compared with last year, what is your current level of optimism regarding the long-term future — five years and beyond — of the U.S. beef industry?”

The majority of all respondents, at 58.2%, say the needle hasn’t moved on their outlook meter, indicating they have about the same level of optimism as last year. 27% are more optimistic and 14.9% are less optimistic (Figure 4).

The 2014 survey results for long-term optimism show a better outlook by readers compared with last year. In 2013, 54% of respondents said their outlook for the long term is about the same, while 25% were more optimistic and 21% were less optimistic.

Of the BEEF readers who are more optimistic in 2014 about the long term, 79.5% anticipate the current supply-demand dynamics will continue, while 62.9% see growing international demand, and 38.6% see better feed and forage conditions. Numbers add up to more than 100% because of multiple responses (Figure 5).

For those who are less optimistic about the industry’s long-term future, 71.6% say government regulations and oversight weigh on their outlook. Increased input costs are a concern for 62.1% of respondents, and concerns about long-term consumer demand were noted by 56.9% of respondents. These numbers add up to more than 100% because of multiple answers.

Management strategies

The BEEF survey also asked how readers are adjusting and adapting their management plans to industry conditions. When asked, “Are you making changes in your management and procurement strategies to reduce input costs?” 81.7% of respondents say yes, and 18.3% say no (Figure 6).

Looking deeper, BEEF then asked which strategies readers use to reduce feed costs. Altering forage management was No. 1, with 57.9% of respondents indicating a change. Putting more pounds on cattle before selling was noted by 34%, and 27.3% are reducing cattle numbers. The latter is nearly identical to the percentage of respondents who indicate they’re still dealing with drought (Figure 7).

In addition, some readers are changing their market timing, with 16% planning to market cattle sooner than last year and 9.3% later than usual. However, 44.7% will market cattle the same time as always, while 30% haven’t yet decided (Figure 8).

The survey results also indicate a changing mindset toward value-added marketing. For 2014, when asked if they sold any cattle in the last 12 months that were eligible for a value-added marketing program, 39.4% of respondents say yes, and 60.6% say no. That compares with the 2013 survey, when 45.8% of respondents sold value-added-eligible cattle and 54.2% did not (Figure 9).

Slightly lower numbers were also noted when readers were asked if they received a premium for their cattle relative to the nearby market. In 2014, 73.8% of respondents say yes, and 26.2% say no. Last year, 75.1% of respondents sold for a premium, while 24.9% did not.

In a volatile and changing market environment, using financial analysis to track operational health becomes important. The majority of respondents, 66.5%, say they use net profit/cow to track financial results; 31.8% use value of gain; 30.5% use cow breakeven; 22.8% use return on assets/head; and 22.8% use return on equity/head. Numbers add up to more than 100% because of multiple responses, indicating many respondents use more than one method (Figure 10).

Current issues

And finally, readers think that conditions within the beef industry are good, but they have concerns about the country as a whole. A majority of respondents, 50.9%, says the level of unity and cooperation within the U.S. beef industry has stayed the same, while 27.1% say it has improved, 12.4% think it has decreased and 9.6% don’t know (Figure 11).

On the other hand, when asked if the U.S. is headed in the right direction, 53.4% say no, while 24.7% say yes and 21.9% don’t know (Figure 12).

On the other hand, when asked if the U.S. is headed in the right direction, 53.4% say no, while 24.7% say yes and 21.9% don’t know (Figure 12).

All in all, the annual BEEF State of the Industry survey shows beef producers are looking ahead with optimism as they position themselves to take advantage of high prices for the next few years.

As one reader commented, “I believe the mission of the beef industry is primarily to utilize available resources effectively to produce high-quality protein for those who choose to consume beef as part of a healthy diet. I believe we can continue to be successful in accomplishing that mission.”

As one reader commented, “I believe the mission of the beef industry is primarily to utilize available resources effectively to produce high-quality protein for those who choose to consume beef as part of a healthy diet. I believe we can continue to be successful in accomplishing that mission.”

You might also like:

Rancher Demonstrates The Benefits Of Hedging For Cowmen

3 Ways Beef Is Making A Comeback With Consumers

Brighten Your Day With Holmes and Fletcher Cartoons

5 Essential Steps For Fly Control On Cattle

What Happens When A DVM & An MD Talk Antibiotics?

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)