The 50¢ move in corn basis since last summer represents a value difference of nearly $30/head between the northern and southern regions – the equivalent of $4-$5/cwt. for a 750-lb. steer.

July 23, 2014

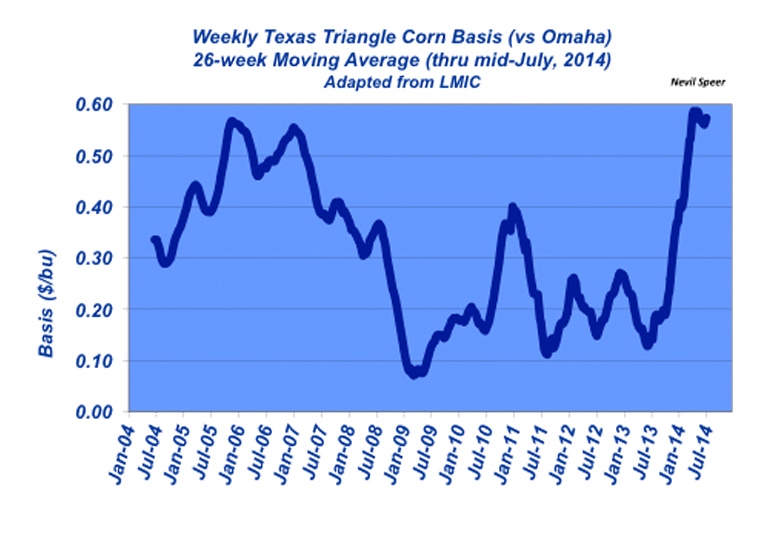

A previous chart in “Industry At A Glance” discussed the shifting dynamics within the feeding sector. In particular, this looked at the geographical differences between the northern and southern tiers.

There’s been any number of factors that have contributed to an increasing proportion of the nation’s fed cattle supply moving north (i.e., Nebraska, Iowa and South Dakota). Chief among these considerations are the drought-induced cowherd liquidation in the South and the introduction of the renewable fuels (ethanol) mandate in 2005.

With the latter in mind, ready availability of ethanol byproducts in the northern states has helped generate demand for feeder cattle in the region. However, following a sharp basis peak in 2006, corn price basis has largely stabilized between the two regions. Stated another way, if southern feedyards wanted to include distillers byproducts, they often had to assume higher freight costs vs. northern feeders. At the same time, corn basis has largely chopped 10-20¢/bu. for the past several years.

Drilling down into the past 12 months tells a different story. Just a year ago, corn prices in the Texas Triangle were running 10¢/bu. ahead of Omaha’s corn market. Since that time, though, the price difference has changed dramatically with the 26-week moving average spiking at 60¢ in 2014.

Consider that each 10¢ move represents approximately $6/head over a 150-160-day feeding period. In other words, the 50¢ move since last summer represents a value difference of nearly $30/head between the northern and southern regions – the equivalent of $4-$5/cwt. for a 750-lb. steer.

All of that stems from both greater corn availability in the northern region and higher fuel prices. That said, the 2014 corn crop is shaping up to be an outstanding one. Nationwide, the crop has experienced very little stress. That will help keep a lid on corn prices going forward. Meanwhile, fuel price predictions continue to remain relatively bullish.

How do you see this trend shaping up going forward? Will the corn basis between the Texas Triangle and Omaha remain strong and/or widen even further? Or will it moderate in the coming months? If it stays strong, what impact might that have on the feeding sector in the year(s) to come?

Leave your thoughts below.

About the Author(s)

You May Also Like