Farm Business Management

More Topics

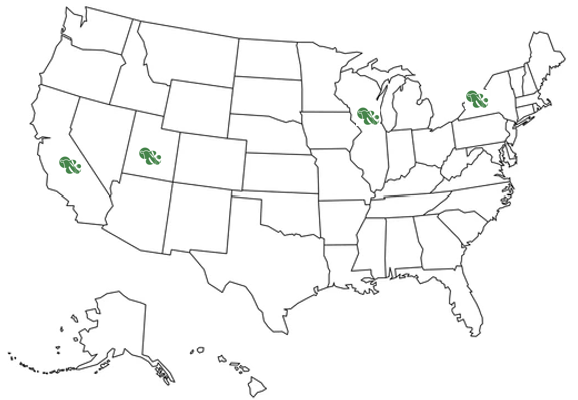

thumbnail

Policy

Changing demographics, aging population to impact protein sectorsChanging demographics, aging population to impact protein sectors

Todd Thurman discusses with podcast hosts Sarah Muirhead of Feedstuffs and Mark Huslebus of Alltech the changing global demographics and their impact on the pork industry.

Subscribe to Our Newsletters

BEEF Magazine is the source for beef production, management and market news.