Click here to download a PDF of this article.

As calf prices continue upward, I receive more phone calls on beef cow leasing. Some are from investors hoping to capture the economic profits from beef cows. Others are from working ranchers looking to lease cows as an alternative to financing their herd expansion. In either case, when done properly, beef cow leasing can be a win-win for both business partners.

A beef cow leasing or sharing arrangement allows two business partners to share the production costs and, in turn, the cowherd income. The issue is what constitutes an equitable or fair way to share the beef cow income? Here are my suggestions for determining an equitable beef cow leasing agreement.

An equitable agreement is one where the two parties share the calf crop in the same proportions that they share the production costs. If the cow owner provides 25% of the production costs of operating the beef cowherd, and the working rancher provides the remaining 75%, then an equitable deal would be for the beef cow owner to get 25% of the calf crop and the working rancher to get the remaining 75% of the calf crop.

The beauty of a beef cow share agreement is that production expenses can be shared in many different ways, as long as the calf crop is shared in the same proportion as the expenses. Typically, the cow owner provides the cows and the replacement heifers, while the participating rancher provides the rest of the resources.

Whoever owns the bulls gets the cull bull income, which should be negotiated and specified as part of the initial written business agreement. Often, the cow owner wants to provide the bulls in order to control the calves’ genetics.

I recommend against including replacement heifers in the cow-share agreement. My experience shows it doesn’t work and can quickly lead to dissatisfaction by one or both business partners. Instead, I suggest that replacement heifers be developed by a third party, and be the responsibility of the cow owner.

The hardest part of putting together an equitable beef cow share agreement is projecting the “full” costs of production used to determine the equitable calf-crop shares. Full costs should include all resources employed in the beef-cow enterprise. These would include the enterprise direct costs, an opportunity cost for the rancher’s labor and management, and the equity capital provided by both business parties. Cow depreciation should be included in place of replacement heifer costs.

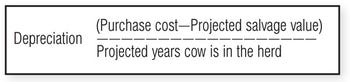

Cow depreciation can be calculated as follows:

Salvage value is the projected value of the cull cows at the time the cows are culled from the leased herd. Cull-cow income goes to the cow owner.

Salvage value is the projected value of the cull cows at the time the cows are culled from the leased herd. Cull-cow income goes to the cow owner.

There are tools available on the Internet to help calculate the full costs of running beef cows. One such spreadsheet is available from the University of Nebraska. Go to www.agmanagerstools.com, click “Livestock Production Decision Aids,” and then select “Cow-Calf Share Lease Cow-Q-Lator.”

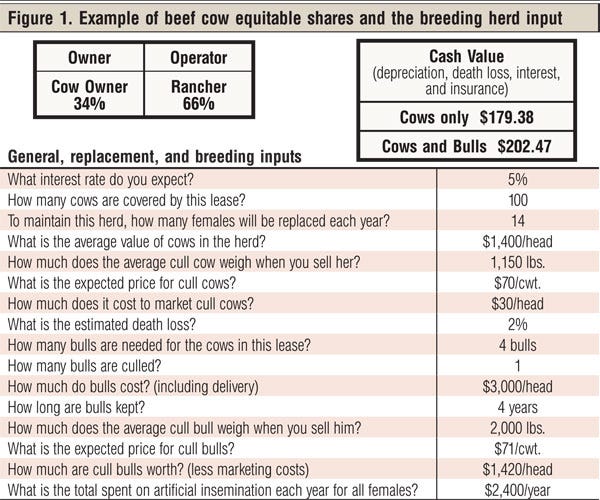

I used this spreadsheet to generate the example data in Figure 1. It’s for a 100-cow herd with a 14% culling rate. Average cow investment was $1,400/cow with projected $70 cull cows and $71 cull bulls. Replacement bulls were projected to cost $3,000.

The top section presents the calculated equitable share percentages for my example herd. The bottom section presents some of the input numbers used in the equitable share calculations. This example herd data suggests a 34/66 equitable split of the calf crop. I would suggest rounding it to 35/65, in which the cow owner gets 35% of the calf crop and the working rancher gets 65% of the calf crop.

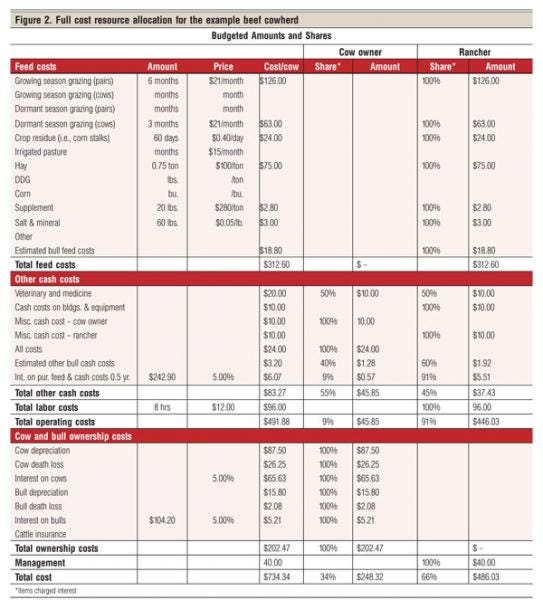

Meanwhile, Figure 2 depicts the operating and ownership costs, and the resource allocation assumed, for this example herd. In this agreement, the working rancher is to provide all summer and winter feed, with the annual market value of the feeds fed projected at $312/cow. Farm-raised feeds are priced at market value, not the cash costs of producing them. Vet and medicine costs are shared, with the cow owner providing the vaccines and the working rancher the labor. The “share column” specifies how all other expenses are to be shared.

The flexibility of this approach is that these resources can be shared in any proportions agreeable to both parties. This, in turn, suggests there should not be one common leasing arrangement across the board for leasing beef cows. Yet, this is what I tend to run into.

In today’s rapidly changing economic times, one might want to re-specify the equitable share percentages annually or semi-annually as resource prices change. To do so, just specify this recalculation frequency in the initial written agreement.

I have two final cautions.

• First, these agreements should be in writing, with the written contract clearly identifying all the agreed-on specifics. Be sure to cover all production costs, identify expected death losses and establish associated penalties for excess death loss, and specify exactly how the business agreement is to be terminated. It’s a lot easier to work out the details before the agreement is signed than to work out a termination agreement after an emergency or disagreement occurs.

• Second, any two parties can enter into any legal agreement that both agree to, even if it’s not equitable.

Harlan Hughes is a North Dakota State University professor emeritus. He lives in Laramie, WY. Reach him at 701-238-9607 or [email protected].

About the Author(s)

You May Also Like