The return of the cattle cycle’s boom and bust eras has come with a vengeance. Cattle prices spent a large part of 2016 going down and down. Each month’s October 2016 price projection for the last six-plus months has been lower than the previous month’s projections.

The eastern Wyoming-western Nebraska sale barn price for 569-pound steer calves produced for my study herd was $134 per cwt in mid-October 2016. This is down from $218 for steer calves sold in October 2015. My study herd manager did not sell any of his 2016 calves at weaning this year.

In all of my economic analyses of beef cow herds, I consider the beef cow business year going from weaning to weaning, so I closed out my study herd’s 2016 analysis in late October 2016. The calves produced were priced at weaning to close out the books on the beef cow enterprise. When the calves are not actually sold at weaning, they are transferred into a retained ownership enterprise at the going local sale barn price for the weaning week.

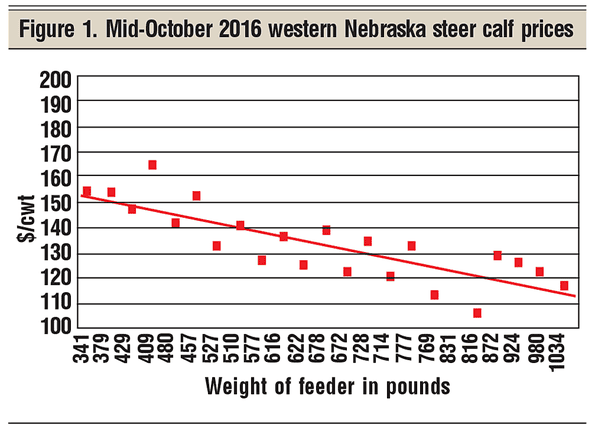

I share with you in Figure 1 the pathetic market price report generated for the week of Oct. 15, 2016. Three things stand out in Figure 1. First, the prices are all over the board. I have not seen this kind of a price scatter for a long time — maybe never. Second, the price of weaned calves relative to heavy feeders was at a discount, as implied by the flat slope of the trend line (i.e., an implied small price slide) in Figure 1. Third, the trend line was one of the flattest trend lines that I have ever calculated.

I calculate that fancy calves sold mid-October at a $14 premium on average, and that freshly weaned calves sold at a $9 discount on average. In summary, steer calf prices were all over the chart — unprecedented and suggesting a somewhat strange market.

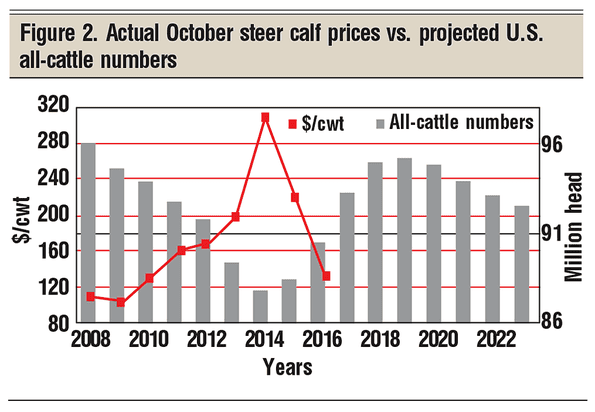

Let’s put these October 2016 prices in perspective (Figure 2). The gray bars represent my projected all-cattle numbers projected through 2023. These all-cattle numbers were projected a couple of years ago. The red line represents the eastern Wyoming-western Nebraska mid-October actual steer calf price for 2006 through 2016.

Combine increased cattle numbers with the fact that cattle are getting bigger each year, and I think we have a partial explanation for the large negative price response in the current price cycle. I fully expect these all-cattle number projections may now be too high given our bigger cattle. This year’s negative prices should surely reduce the all-cattle numbers that I projected for 2017 through 2023. Time will tell.

Economic implications for study herd

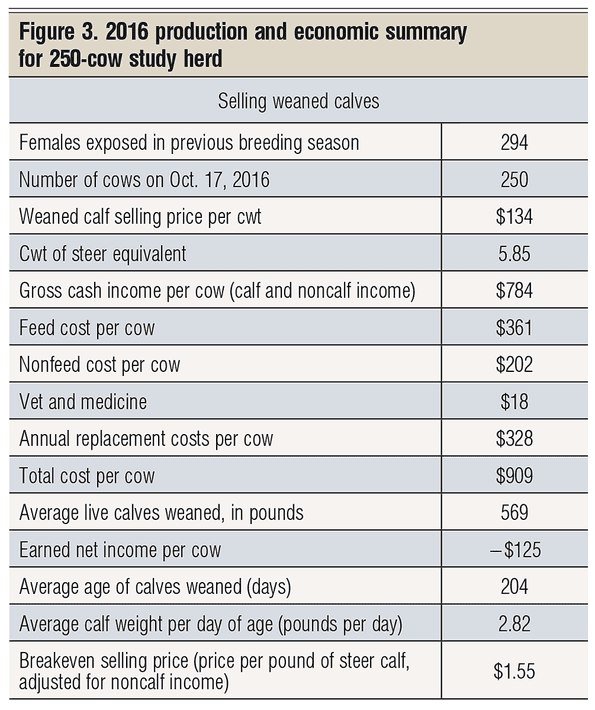

The sale barn prices presented in Figure 1 do not translate into good news for my eastern Wyoming-western Nebraska study rancher (Figure 3). This study herd is a 250-head cow herd that maintains 250 cows year-in and year-out. Each year, the manager holds back, on average, 44 replacement heifers to replace his culled cows and cows that die.

Last year, my study rancher exposed 294 females to the bulls at breeding time (250 mature cows and 44 replacement heifers). He weaned an 87% calf crop this year (87% of females exposed). These weaned heifer and steer calves average 569 pounds, and steers calves were priced at $134 per cwt. Income from cull cows, cull bulls and cull open heifers brought the gross income to $784 per cow in the January 2016 inventory.

Total costs of production for 2016 came to $909 per cow, where farm-raised feeds and grass were priced in at fair market price. Earned net income came to a negative $125 per cow.

It is important here to understand that earned net income is the earned return to unpaid family labor, management and equity capital. The last time that I reported a negative earned net return was in 2009 — the beginning year of the current price cycle.

The red line in Figure 2 represents the current beef price cycle caused by the current beef cattle cycle, I suspect that we will need to at least add 2017’s October price to complete this price cycle. At this point, I do not see much of a calf price increase until after we sell off some breeding cows nationally. That probably will take at least another year or more.

The average age of the calves in my study herd was 204 days of age (see Figure 3), and average weight per day of age was 2.82 pounds. The breakeven sale price for these calves was calculated at $1.55 per pound weaned.

A producer called me about a previous article, and we were talking about the bottom line of my study herd. He said that price does not pay him for his labor, management and investment. Yes, that is right.

I pointed out that economists like full-cost budgets where they put a cost on all labor, add in a management charge and put a cost on investment capital. However, I have found that most ranchers do not put a charge on their own labor, unpaid family labor, management and equity capital. So that’s why I typically do not include a cost of the family’s resources contributed to the beef cow herd.

Please remember, grass was priced in at going rental rates. Farm-raised feeds were priced in at market price, not cost of production. Space precludes my going into detail, but my study rancher owned the grass land and did make some money raising alfalfa and grass hay in 2016; however, he about broke even raising corn in 2016.

In next month’s Market Adviser, we will take a look at the economics of the total ranch business and focus on some business changes that my study rancher might consider for 2017 and 2018. However you do your business accounting on your ranch, 2016 will go down as a tough, tough year.

Harlan Hughes is a North Dakota State University professor emeritus. He lives in Kuna, Idaho. Reach him at 701-238-9607 or [email protected].

About the Author(s)

You May Also Like