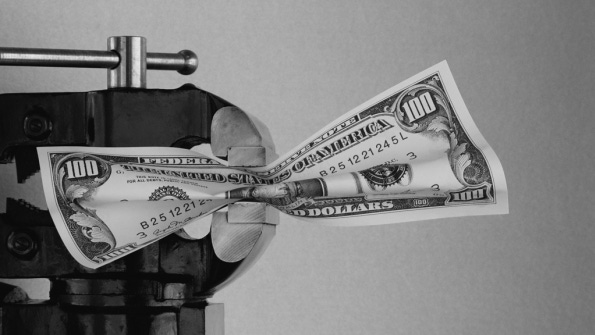

Not only is the farm economy slowing, but the international economy is in downturn. Be prepared.

If you aren't feeling the squeeze of hard times on the farm, you may yet, and you need to be prepared.

The first problem is the international and U.S. economy. Massive debt bubbles exist all over the world, including here. This is true for all public and private sectors.

We also are well into massive decreases in consumer earning and purchasing power. The Federal Reserve Bank database (FRED) in St. Louis, Mo., says real, inflation-adjusted median household incomes peaked in 1999 and have been declining significantly ever since. It says that measure of income peaked at $57,805 in 1999, and in the year 2015, real median U.S. household income was $53,745, a 23% decline over 18 years.

Gross domestic product (GDP), a measure of productivity and overall economic activity, has been about 1.25% in the U.S. since 2008, which is lower than in the 10 years of the Great Depression.

Slow money

Another way of measuring economic activity is velocity of money, sometimes known as M2. In fact, it is considered by many a good future predictor of economic activity.

It is the year-to-year percentage change (increase or decrease) of the volume and rate of change in the total combined consumer, family, corporate and business spending. It is tracked by the St. Louis Federal Reserve Bank.

The U.S. velocity of money has been declining rapidly since its high-water mark in 1997. The rate of decline in the velocity of money has accelerated since about 2008. It was 1.48% in calendar year 2015 and appears headed lower.

Of course, the macro economy is contributing to the downturn in agricultural commodities, and cattle prices over the next couple years are expected to continue sliding.

Wall of meat

Rabobank recently warned that consumers in the U.S. are facing a glut of meat production, and all meat prices over the next couple years are expected to fall, with beef taking the largest hit.

Analysts at Rabobank Food & Agribusiness Research and Advisory group said protein production in the U.S. is projected to grow at a rate of 2.5% annually, and then decline to about 1.5% per year.

Further, those analysts say much of this protein production will have to be consumed here at home, ultimately driving prices so much lower that by 2018, there could be some industry restructuring, or at least opportunities for some wily producers and meat companies.

They wrote: "We expect U.S. protein production growth of 2.5% per annum through 2018 -- down from 3% in 2015 -- with beef being the largest contributor relative to pork and poultry. Trade appears to have stabilized in 2016 thus far; however, we don't foresee international markets absorbing all of this production growth, thus requiring further increases in domestic consumption toward the all-time peak of the mid-2000s, which will ask a lot of U.S. consumers and will come at the cost of lower prices.

"By the end of this expansion cycle in late 2018, we expect a more challenging profit environment across the U.S. meat industry, providing strategic opportunities for those producers with the capital and foresight to take advantage of them."

Rabobank analysts called the overall market situation for beef "a real mixed bag."

The report concludes with the prediction that U.S. retail meat prices will decline by 14% by 2018, from 2015, on a consumption-weighted basis, and that beef prices will be the major driver of that downtrend.

"Of the three major proteins, we expect beef to have the largest amount of deflation at retail, to the tune of 22%, followed by pork at 7% and chicken at 5%," analysts said. "Relative to historic levels of U.S. retail meat prices, this cycle of U.S. protein deflation will bring prices back to near-2012 levels, which is not the worst thing, as feed costs have generally halved since then."

Land values

With all the deflation in commodities, farmland value is in decline, and most analysts suggest it has legs to walk farther yet down the price steps.

A new report from Rabobank says farmland rent values must drop to meet lower commodity prices, and it's highly probably all land values will fall, too.

The research arm of the international bank says using its baseline price projections of corn below $4 per bushel, soybeans below $10.20 per bushel and wheat prices falling in the $4- to $5-per-bushel range, rental rates need to decline from an expected $1.60 per expected bushel of corn produced to around $1.30 per bushel.

This is if the costs of seed, crop protection and fertilizer remain relatively flat. Generally this means a $30- to $50-per-acre decrease.

Even with a decline in rental values, farmland acreage contraction will still likely be needed before commodity prices reach a sustainable level in the long term, Rabobank analysts said.

The result of acres being forced out of row-crop production will be additional downward pressure on the overall value of agricultural land. This suggests more acres for beef production, and lower pasture and forage values at a time the expansion of beef production is very likely to be slowing. That could add to down pressure on pasture prices and rental values, so that's why the Rabobank analysts described the overall market as a mixed bag for the beef industry.

More predictions

Olathe, Kan.-based private economist Bill Helming has correctly predicted an ongoing U.S. depression since 2008, with U.S. gross domestic product (GDP) in the range of the years of the Great Depression of the 1930s. He continues to warn about downturns from massive debt accumulation in the U.S. and worldwide, and his analysis and predictions are actually worse than those of Rabobank analysts -- but in line with well-known analyst Harry Dent.

Helming says between the end of December 2017 and the summer and fall months of 2018, fed cattle prices will reach $85 to $92 per hundredweight. He says agricultural banks will experience serious ag loan losses, and farmland values and that farm rental rates will decline by 35% to 50% within the next 24 to 36 months.

Regardless of what exactly comes to pass, this will cause hardships for agricultural service industries like the veterinary business.

You might also like:

9 new pickups for the ranch in 2016

Seven keys to ranch profitability

Young ranchers, listen up: 8 tips from an old-timer on how to succeed in ranching

About the Author(s)

You May Also Like